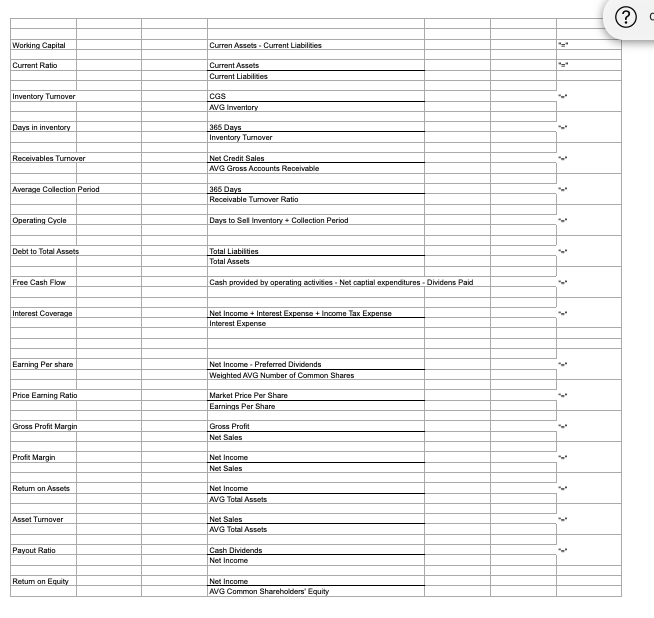

Question: please solve the formula with those information (? Working Capital Curren Assets. Current Liabilities Current Ratio Current Assets Current Liabilities Inventory Turnover COS AVG Inventory

please solve the formula with those information

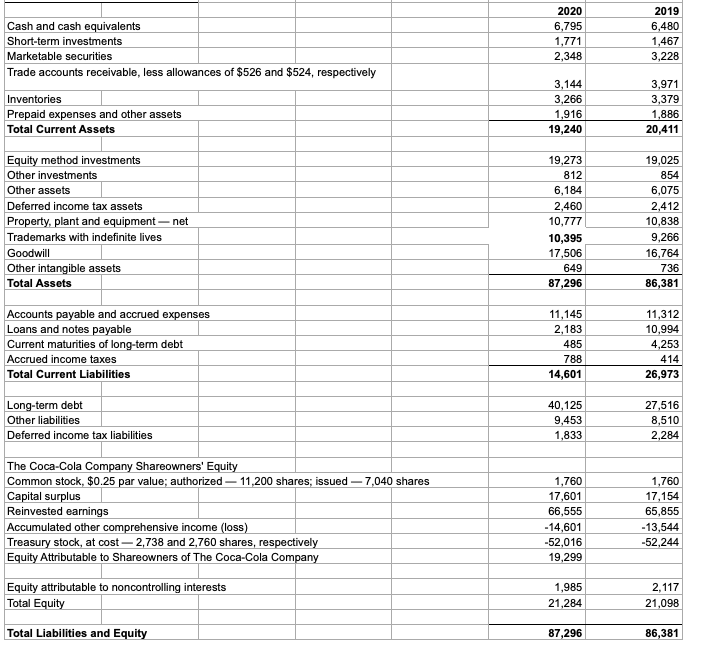

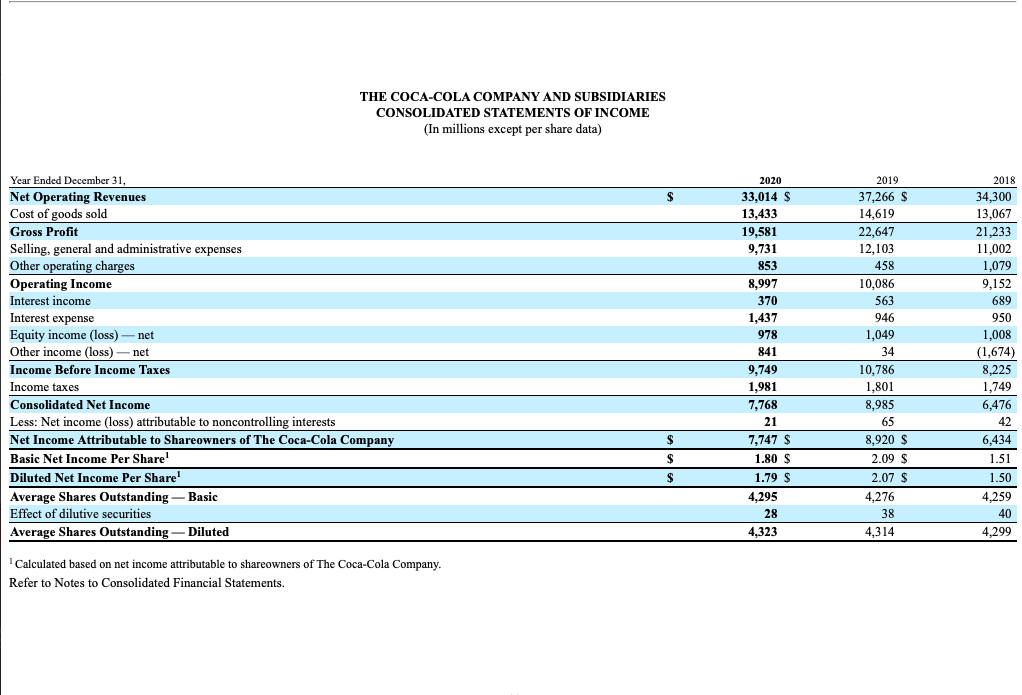

(? Working Capital Curren Assets. Current Liabilities Current Ratio Current Assets Current Liabilities Inventory Turnover COS AVG Inventory Days in inventory 366 Days Inventory Turnover Receivables Turnover Net Credit Sales AVG Gross Accounts Receivable Average Collection Period 365 Days Receivable Turnover Ratio Operating Cycle Days to Sel Inventory Collection Period Debt to Total Assets Total Liabilities Total Assets Free Cash Flow Cash provided by operating activities - Net captial expenditures - Dividens Paid Interest Coverage Net Income + Interest Expense + Income Tax Expense Interest Expense Earning Per share Net Income. Preferred Dividends Weighted AVG Number of Common Shares Price Earning Ratio Market Price Per Share Earnings Per Share Gross Profit Margin Gross Profit Net Sales Profit Margin Net Income Net Sales Retum on Assets Net Income AVG Total Assets Asset Turnover Net Sales AVG Total Assets Payout Ratio Cash Dividends Net Income Return on Equity Net Income AVG Common Shareholders' Equity THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions except per share data) S 2018 34,300 13,067 21,233 11,002 1,079 Year Ended December 31, Net Operating Revenues Cost of goods sold Gross Profit Selling, general and administrative expenses Other operating charges Operating Income Interest income Interest expense Equity income (loss) - net Other income (loss) - net Income Before Income Taxes Income taxes Consolidated Net Income Less: Net income (loss) attributable to noncontrolling interests Net Income Attributable to Shareowners of The Coca-Cola Company Basic Net Income Per Share! Diluted Net Income Per Share! Average Shares Outstanding - Basic Effect of dilutive securities Average Shares Outstanding - Diluted 2020 33,014 $ 13,433 19,581 9,731 853 8,997 370 1,437 978 841 9,749 1,981 7,768 21 7,747 $ 1.80 $ 1.79 $ 4.295 28 4,323 2019 37,266 $ 14,619 22,647 12,103 458 10,086 563 946 1,049 34 10,786 1,801 8,985 65 8,920 $ 2.09 $ 2.07 $ 4,276 38 4,314 9,152 689 950 1,008 (1,674) 8,225 1,749 6,476 42 6,434 1.51 1.50 4.259 40 4,299 $ $ S Calculated based on net income attributable to shareowners of The Coca-Cola Company. Refer to Notes to Consolidated Financial Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts