Question: Please solve the numerical then draw the conclusion. Will definitely upvote the same Q2. Suppose an investment has conventional cash flows with positive NPV. How

Please solve the numerical then draw the conclusion.

Will definitely upvote the same

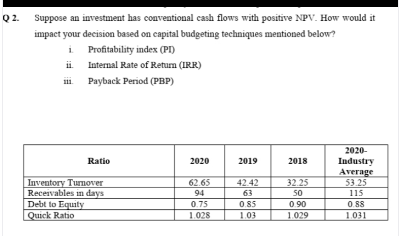

Q2. Suppose an investment has conventional cash flows with positive NPV. How would it impact your decision based on capital budgeting techniques mentioned below? i Profitability index (PI) ii. Internal Rate of Return (IRR) ii. Payback Period (PBP) Ratio Inventory Turnover Receivables in days Debt to Equity Quick Ratio 2020 62.65 94 0.75 1.028 2019 42.42 63 0.85 1.03 2018 32.25 50 0.90 1.029 2020- Industry Average 53.25 115 0.88 1.031

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock