Question: Please solve the only question (b) 1. Assume returns are normally distributed with expected excess return u and the covariance matrix E, investors have CARA

Please solve the only question (b)

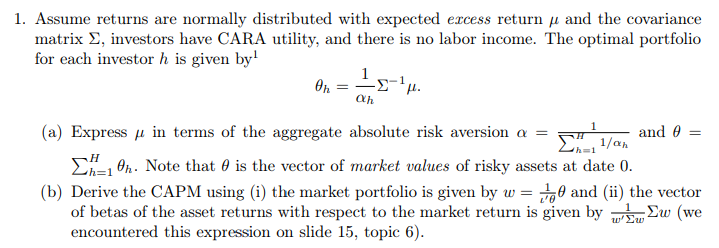

1. Assume returns are normally distributed with expected excess return u and the covariance matrix E, investors have CARA utility, and there is no labor income. The optimal portfolio for each investor h is given by On '. = ah 1 h=1 (a) Express u in terms of the aggregate absolute risk aversion a = - 1/24 and @ ch Oh. Note that 6 is the vector of market values of risky assets at date 0. (b) Derive the CAPM using (i) the market portfolio is given by w = to and (ii) the vector of betas of the asset returns with respect to the market return is given by wlu Sw (we encountered this expression on slide 15, topic 6). 1. Assume returns are normally distributed with expected excess return u and the covariance matrix E, investors have CARA utility, and there is no labor income. The optimal portfolio for each investor h is given by On '. = ah 1 h=1 (a) Express u in terms of the aggregate absolute risk aversion a = - 1/24 and @ ch Oh. Note that 6 is the vector of market values of risky assets at date 0. (b) Derive the CAPM using (i) the market portfolio is given by w = to and (ii) the vector of betas of the asset returns with respect to the market return is given by wlu Sw (we encountered this expression on slide 15, topic 6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts