Question: please solve the problem step by step and calculate the right answers for me. Thanks, will upvote if the answers are correct. Problem 5. (20

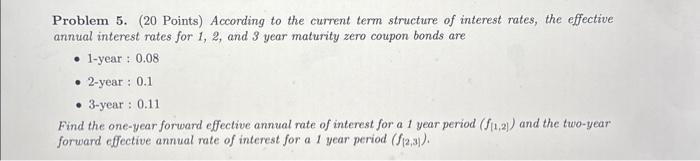

Problem 5. (20 Points) According to the current term structure of interest rates, the effective annual interest rates for 1,2 , and 3 year maturity zero coupon bonds are - 1-year : 0.08 - 2-year : 0.1 - 3-year : 0.11 Find the one-year forward effective annual rate of interest for a 1 year period (f[1,2]) and the two-year forward effective annual rate of interest for a 1 year period (f[2,3})

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts