Question: Please solve the problem utilizing Microsoft Excel and showcase the formulas used to get the answers. Thank you! 4. Valuing a company Schultz Industries is

Please solve the problem utilizing Microsoft Excel and showcase the formulas used to get the answers. Thank you!

Please solve the problem utilizing Microsoft Excel and showcase the formulas used to get the answers. Thank you!

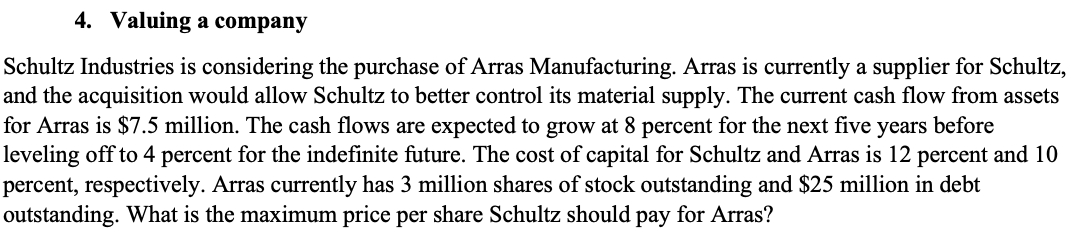

4. Valuing a company Schultz Industries is considering the purchase of Arras Manufacturing. Arras is currently a supplier for Schultz, and the acquisition would allow Schultz to better control its material supply. The current cash flow from assets for Arras is $7.5 million. The cash flows are expected to grow at 8 percent for the next five years before leveling off to 4 percent for the indefinite future. The cost of capital for Schultz and Arras is 12 percent and 10 percent, respectively. Arras currently has 3 million shares of stock outstanding and $25 million in debt outstanding. What is the maximum price per share Schultz should pay for Arras

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts