Question: Please solve the question below The expected return for share DEAD is 3.20%, and for share, ALIVE is 4.70%. The standard deviation of share ALIVE

Please solve the question below

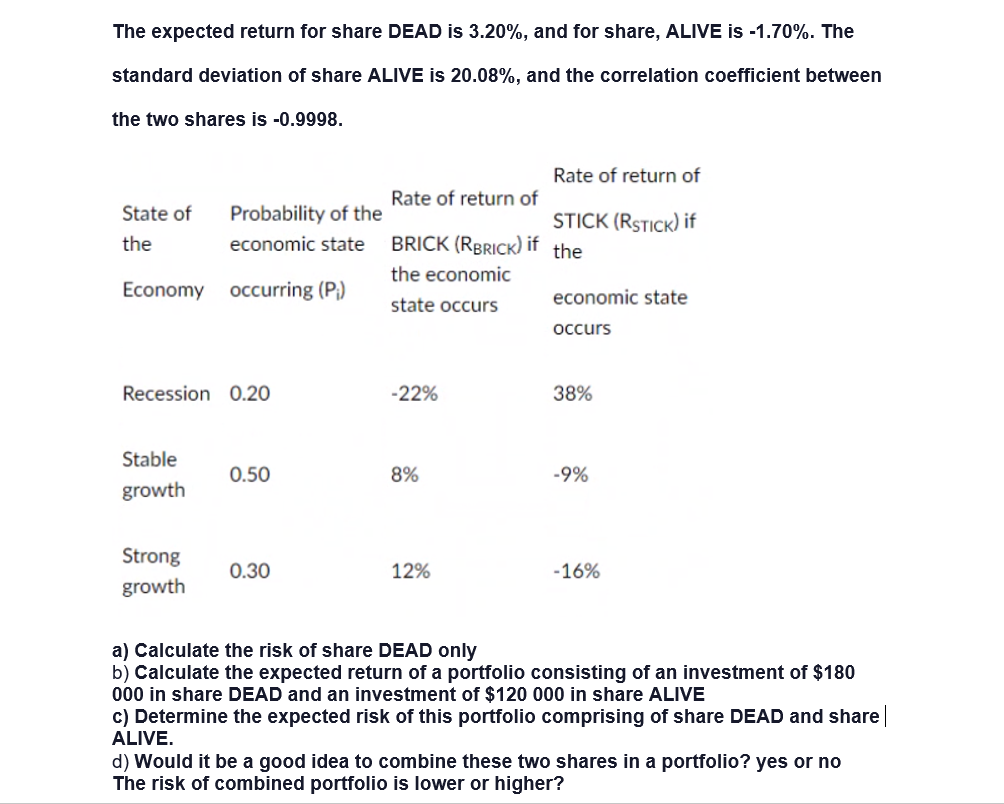

The expected return for share DEAD is 3.20%, and for share, ALIVE is 4.70%. The standard deviation of share ALIVE is 20.08%, and the correlation coefcient between the two shares is 09998. Rate of return of Rate of return of State Of Probability Of the STICK (RSTICKJ' if the economic state BRICK (RBRICK) if the . the economic Economy occurring (Pi) state occurs economic state occurs Recession 0.20 -22% 38% Stab! e 0.50 3% 49% growth St \""3 0.30 12% - 16% growth a) Calculate the risk of share DEAD only b) Calculate the expected return of a portfolio consisting of an investment of $130 000 in share DEAD and an investment of $120 000 in share ALIVE c) Determine the expected risk of this portfolio comprising of share DEAD and share | ALIVE. d) Would it be a good idea to combine these two shares in a portfolio? yes or no The risk of combined portfolio is lower or higher

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts