Question: Please solve the question if you are completely sure about the solution ( with steps), otherwise I will downvote it. Thanks. On January 1, 2021,

Please solve the question if you are completely sure about the solution ( with steps), otherwise I will downvote it.

Thanks.

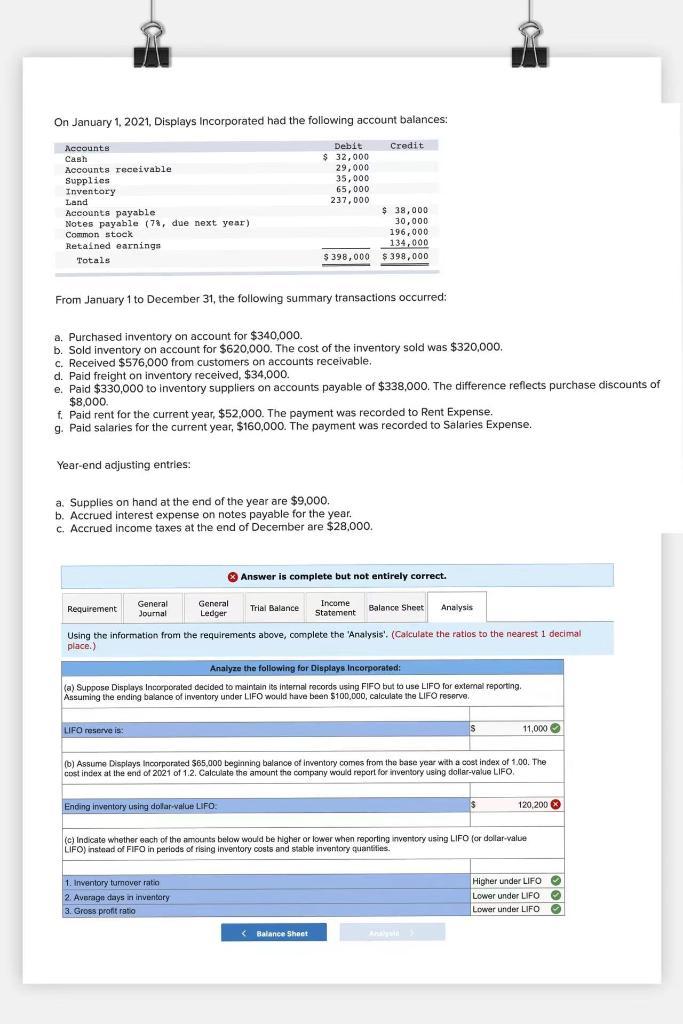

On January 1, 2021, Displays Incorporated had the following account balances: Accounts Cash Accounts receivable Supplies Inventory Land Accounts payable Notes payable (78, due next year). Common stock Retained earnings Totals Year-end adjusting entries: From January 1 to December 31, the following summary transactions occurred: a. Purchased inventory on account for $340,000. b. Sold inventory on account for $620,000. The cost of the inventory sold was $320,000. Requirement c. Received $576,000 from customers on accounts receivable. d. Paid freight on inventory received, $34,000. e. Paid $330,000 to inventory suppliers on accounts payable of $338,000. The difference reflects purchase discounts of $8,000. f. Paid rent for the current year, $52,000. The payment was recorded to Rent Expense. g. Paid salaries for the current year, $160,000. The payment was recorded to Salaries Expense. a. Supplies on hand at the end of the year are $9,000. b. Accrued interest expense on notes payable for the year. c. Accrued income taxes at the end of December are $28,000. General Journal LIFO reserve is: Debit $ 32,000 General Ledger 29,000 35,000 65,000 237,000 $ 38,000 30,000 196,000 134,000 $398,000 $398,000 Trial Balance Ending inventory using dollar-value LIFO Credit 1. Inventory turnover ratio 2. Average days in inventory 3. Gross profit ratio Answer is complete but not entirely correct. Using the information from the requirements above, complete the 'Analysis'. (Calculate the ratios to the nearest 1 decimal. place.) Income Statement Analyze the following for Displays Incorporated: (a) Suppose Displays Incorporated decided to maintain its internal records using FIFO but to use LIFO for extemal reporting. Assuming the ending balance of inventory under LIFO would have been $100,000, calculate the LIFO reserve..

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts