Question: Please solve the question if you are completely sure about the solution( with steps) , otherwise I will downvote it. Thanks. Zachariah City's water utility

Please solve the question if you are completely sure about the solution( with steps) , otherwise I will downvote it.

Thanks.

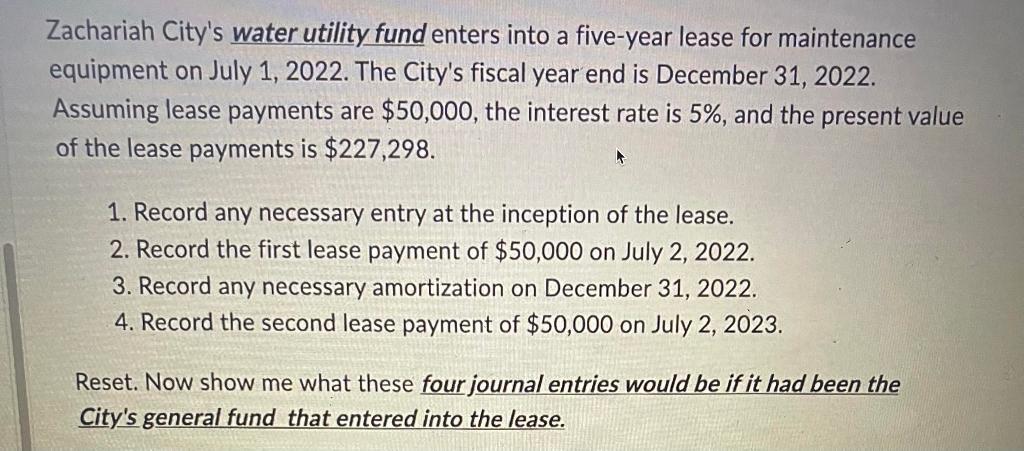

Zachariah City's water utility fund enters into a five-year lease for maintenance equipment on July 1, 2022. The City's fiscal year end is December 31, 2022. Assuming lease payments are $50,000, the interest rate is 5%, and the present value of the lease payments is $227,298. 1. Record any necessary entry at the inception of the lease. 2. Record the first lease payment of $50,000 on July 2, 2022. 3. Record any necessary amortization on December 31, 2022. 4. Record the second lease payment of $50,000 on July 2, 2023. Reset. Now show me what these four journal entries would be if it had been the City's general fund that entered into the lease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts