Question: Please solve the question if you have mastered it and will solve it yourself. Do not copy paste the only answer to this question from

Please solve the question if you have mastered it and will solve it yourself. Do not copy paste the only answer to this question from Chegg answers.

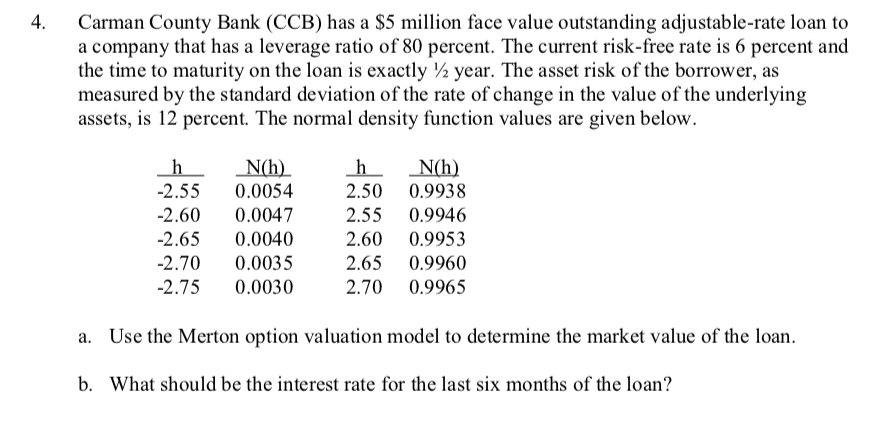

4. Carman County Bank (CCB) has a $5 million face value outstanding adjustable-rate loan to a company that has a leverage ratio of 80 percent. The current risk-free rate is 6 percent and the time to maturity on the loan is exactly 12 year. The asset risk of the borrower, as measured by the standard deviation of the rate of change in the value of the underlying assets, is 12 percent. The normal density function values are given below. h -2.55 -2.60 -2.65 -2.70 -2.75 N(h) 0.0054 0.0047 0.0040 0.0035 0.0030 h N(h) 2.50 0.9938 2.55 0.9946 2.60 0.9953 2.65 0.9960 2.70 0.9965 a. Use the Merton option valuation model to determine the market value of the loan. b. What should be the interest rate for the last six months of the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts