Question: Please solve the question with explanation Additional Information Net revenue during the year was $23,598 Total assets in 2008 and 2009 were $15,429 and $15,707

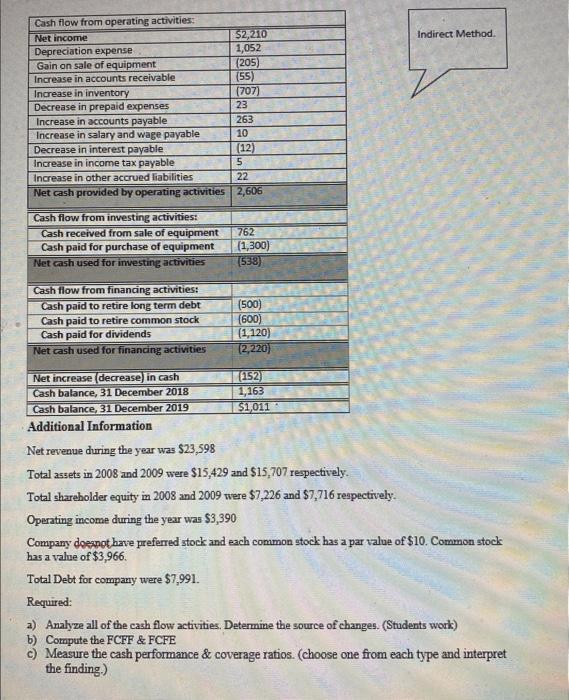

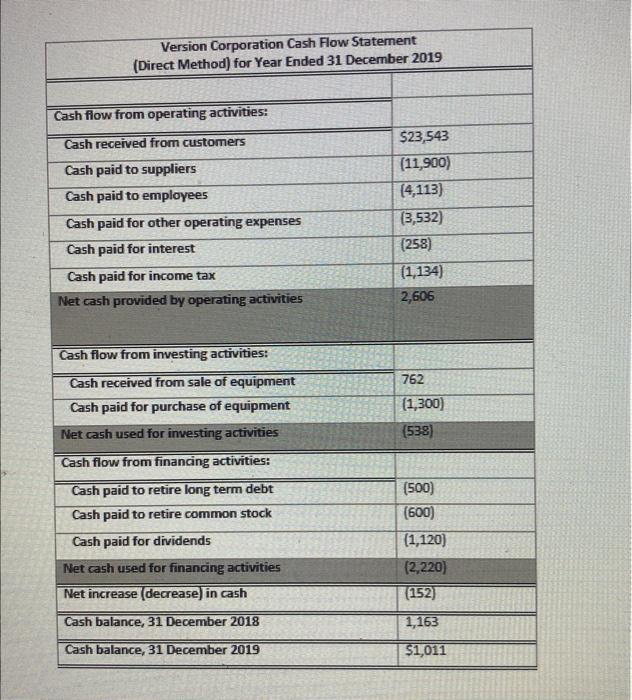

Additional Information Net revenue during the year was $23,598 Total assets in 2008 and 2009 were $15,429 and $15,707 respectively. Total shareholder equity in 2008 and 2009 were $7,226 and $7,716 respectively. Operating income during the year was $3,390 Company doespot have preferred stock and each common stock has a par value of $10. Common stock has a value of $3,966. Total Debt for company were $7,991. Required: a) Analyze all of the cash flow activities. Determine the source of changes. (Students work) b) Compute the FCFF \& FCFE c) Measure the cash performance \& coverage ratios. (choose one from each type and interpret the finding.) Version Corporation Cash Flow Statement (Direct Method) for Year Ended 31 December 2019 \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ (Direct Method) for Year Ended 31 December 2019} \\ \hline \hline & \\ \hline \hline Cash fiow from operating activities: & \\ \hline \hline Cash received from customers & 523,543 \\ \hline Cash paid to suppliers & (11,900) \\ \hline Cash paid to employees & (4,113) \\ \hline Cash paid for other operating expenses & (3,532) \\ \hline Cash paid for interest & (258) \\ \hline Cash paid for income tax & (1,134) \\ \hline Net cash provided by operating activities & 2,606 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \hline Cash flow from investing activities: & \\ \hline \hline Cash received from sale of equipment & 762 \\ \hline Cash paid for purchase of equipment & (1,300) \\ \hline Net cash used for investing activities & (538) \\ \hline \hline Cash flow from financing activities: & (500) \\ \hline \hline Cash paid to retire long term debt & (600) \\ \hline Cash paid to retire common stock & (1,120) \\ \hline Cash paid for dividends & (2,220) \\ \hline Net cash used for financing activities & (152) \\ \hline \hline Net increase (decrease) in cash & 1,163 \\ \hline \hline Cash balance, 31 December 2018 & $1,011 \\ \hline \hline Cash balance, 31 December 2019 & \\ \hline \hline \end{tabular} Additional Information Net revenue during the year was $23,598 Total assets in 2008 and 2009 were $15,429 and $15,707 respectively. Total shareholder equity in 2008 and 2009 were $7,226 and $7,716 respectively. Operating income during the year was $3,390 Company doespot have preferred stock and each common stock has a par value of $10. Common stock has a value of $3,966. Total Debt for company were $7,991. Required: a) Analyze all of the cash flow activities. Determine the source of changes. (Students work) b) Compute the FCFF \& FCFE c) Measure the cash performance \& coverage ratios. (choose one from each type and interpret the finding.) Version Corporation Cash Flow Statement (Direct Method) for Year Ended 31 December 2019 \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ (Direct Method) for Year Ended 31 December 2019} \\ \hline \hline & \\ \hline \hline Cash fiow from operating activities: & \\ \hline \hline Cash received from customers & 523,543 \\ \hline Cash paid to suppliers & (11,900) \\ \hline Cash paid to employees & (4,113) \\ \hline Cash paid for other operating expenses & (3,532) \\ \hline Cash paid for interest & (258) \\ \hline Cash paid for income tax & (1,134) \\ \hline Net cash provided by operating activities & 2,606 \\ \hline \end{tabular} \begin{tabular}{|l|l|} \hline \hline Cash flow from investing activities: & \\ \hline \hline Cash received from sale of equipment & 762 \\ \hline Cash paid for purchase of equipment & (1,300) \\ \hline Net cash used for investing activities & (538) \\ \hline \hline Cash flow from financing activities: & (500) \\ \hline \hline Cash paid to retire long term debt & (600) \\ \hline Cash paid to retire common stock & (1,120) \\ \hline Cash paid for dividends & (2,220) \\ \hline Net cash used for financing activities & (152) \\ \hline \hline Net increase (decrease) in cash & 1,163 \\ \hline \hline Cash balance, 31 December 2018 & $1,011 \\ \hline \hline Cash balance, 31 December 2019 & \\ \hline \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts