Question: Please solve the red boxes On December 27,2021 , Carla Vista Windows purchased a piece of equipment for $110,000. The estimated useful life of the

Please solve the red boxes

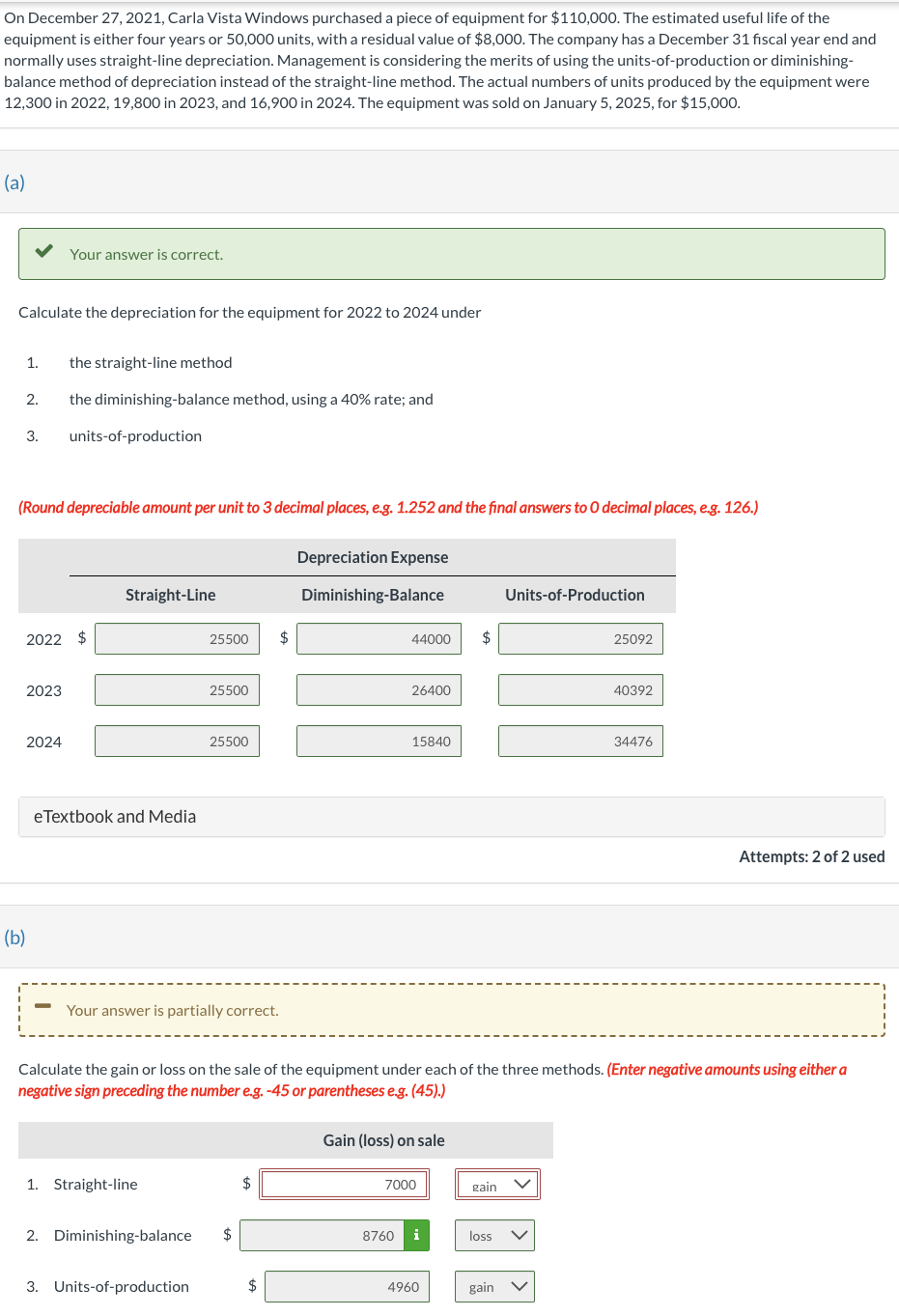

On December 27,2021 , Carla Vista Windows purchased a piece of equipment for $110,000. The estimated useful life of the equipment is either four years or 50,000 units, with a residual value of $8,000. The company has a December 31 fiscal year end and normally uses straight-line depreciation. Management is considering the merits of using the units-of-production or diminishingbalance method of depreciation instead of the straight-line method. The actual numbers of units produced by the equipment were 12,300 in 2022,19,800 in 2023 , and 16,900 in 2024 . The equipment was sold on January 5,2025 , for $15,000. (a) Your answer is correct. Calculate the depreciation for the equipment for 2022 to 2024 under 1. the straight-line method 2. the diminishing-balance method, using a 40% rate; and 3. units-of-production (Round depreciable amount per unit to 3 decimal places, e.g. 1.252 and the final answers to 0 decimal places, e.g. 126.) eTextbook and Media Attempts: 2 of 2 used (b) Calculate the gain or loss on the sale of the equipment under each of the three methods. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts