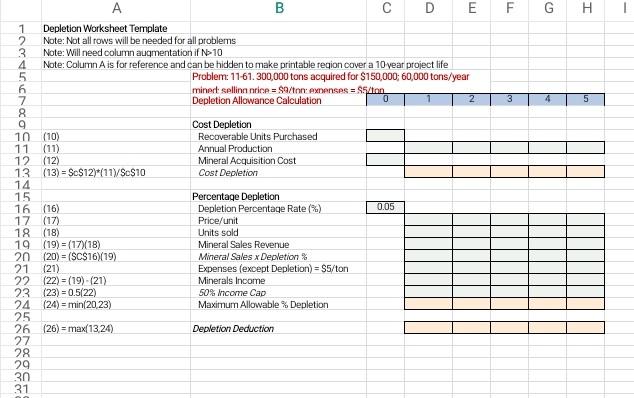

Question: please solve the table below and show all formulas used. thanks F G H 1234567 3 4 5 A B D E Depletion Worksheet Template

please solve the table below and show all formulas used. thanks

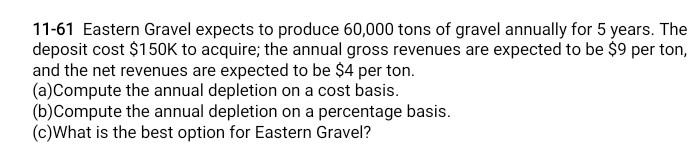

F G H 1234567 3 4 5 A B D E Depletion Worksheet Template Note: Not all rows will be needed for all problems Note: Will need column augmentation if N10 Note: Column A is for reference and can be hidden to make printable region cover a 10 year project life Problem: 1161.300.000 tons acquired for $150,000; 60,000 tons/year minert selling nice = Sg/tone expenses = SS on Depletion Allowance Calculation 2 8 9 Cost Depletion 10 (10) Recoverable Units Purchased 11 (11) Annual Production 12 (12) Mineral Acquisition Cost 13 (13) Sc$12)*(11) Se$10 Cost Depletion 14 15 Percentage Depletion 16 (16) Depletion Percentage Rate(%) 0.05 17 (17) Price/unit 18 (18) Units sold 19 (19) = (17)(18) Mineral Sales Revenue 20 (20) = (SC$16)/19) Mineral Sales x Depletion% 21 (21) Expenses (except Depletion) = $5/ton 22 (22) = (19) (21) Minerals Income 23 (23) = 0.5/22) 50% Income Cap 24 (24) = min(2023) Maximum Allowable % Depletion 25 26 (26) = max(1324) Depletion Deduction 27 28 29 30 31 11-61 Eastern Gravel expects to produce 60,000 tons of gravel annually for 5 years. The deposit cost $150K to acquire; the annual gross revenues are expected to be $9 per ton, and the net revenues are expected to be $4 per ton. (a)Compute the annual depletion on a cost basis. (b)Compute the annual depletion on a percentage basis. (c)What is the best option for Eastern Gravel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts