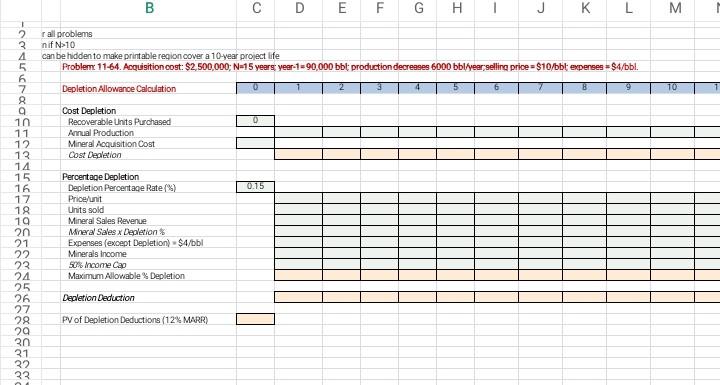

Question: please solve the table below and show all formulas used. thanks B D E F G H J K L M rall problems nif N10

please solve the table below and show all formulas used. thanks

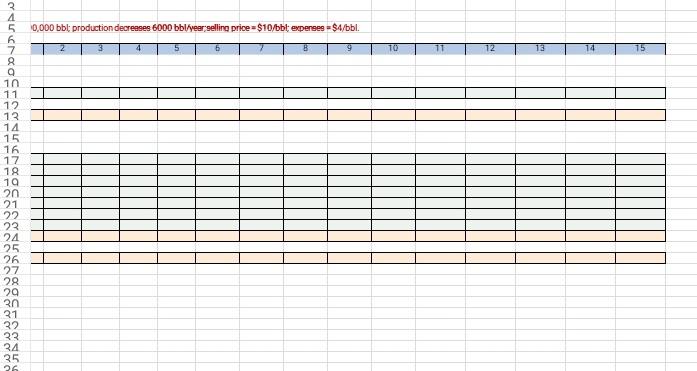

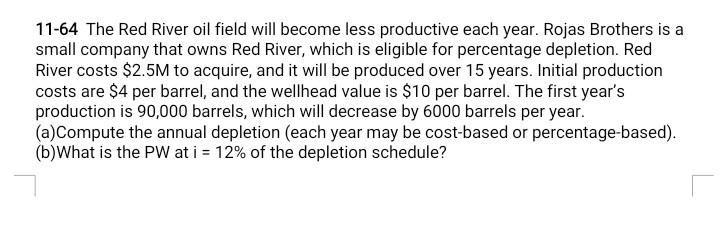

B D E F G H J K L M rall problems nif N10 can be hidden to make printable region cover a 10-year project life Problem 11-64. Acquisition cost: $2,500,000; N-15 years year-1=90,000 bbt production decreases 6000 bbl/year,selling price = $10/bbt expenses = $4/bbl. Depletion Allowance Calculation 0 2 3 4 5 6 B 9 10 1034567Ran12345 0 Cost Depletion Recoverable Units Purchased Annual Production Mineral Acquisition Cost Cost Depletion 0.15 15 16 17 18 19 2n 21 22 23 24 25 26 27 28 29 an 31 32 Percentage Depletion Depletion Percentage Rate) Price/unit Units sold Mineral Sales Revenue Mineral Sales x Depletion Expenses (except Depletion) - $4/bbl Minerals income 50% Income Cap Maximum Allowable : Depletion Depletion Deduction PV of Depletion Deductions (12% MARR) 0,000 bbl production decreases 6000 bbl/yearselling price = $10/bbt, expenses = $4/bbl. 2 4 5 6 B 9 TO 11 12 14 15 CouChaos-awacoa 12 13 14 15 16 17 18 19 2n 21 22 23 24 25 26 27 28 29 an 21 32 33 34 25 26 11-64 The Red River oil field will become less productive each year. Rojas Brothers is a small company that owns Red River, which is eligible for percentage depletion. Red River costs $2.5M to acquire, and it will be produced over 15 years. Initial production costs are $4 per barrel, and the wellhead value is $10 per barrel. The first year's production is 90,000 barrels, which will decrease by 6000 barrels per year. (a)Compute the annual depletion (each year may be cost-based or percentage-based). (b)What is the PW at i = 12% of the depletion schedule

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts