Question: Please solve the wrong answers in Red. Thanks! Prepare an amortization schedule that is suitable for the lessor for the lease term. (Round answers to

Please solve the wrong answers in Red. Thanks!

Please solve the wrong answers in Red. Thanks!

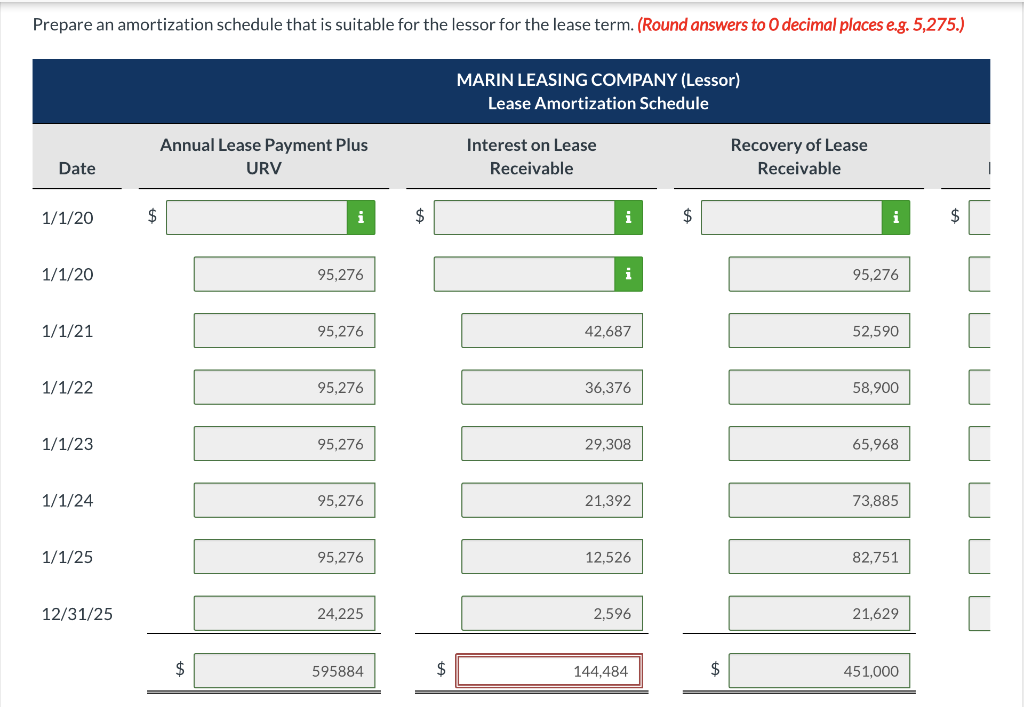

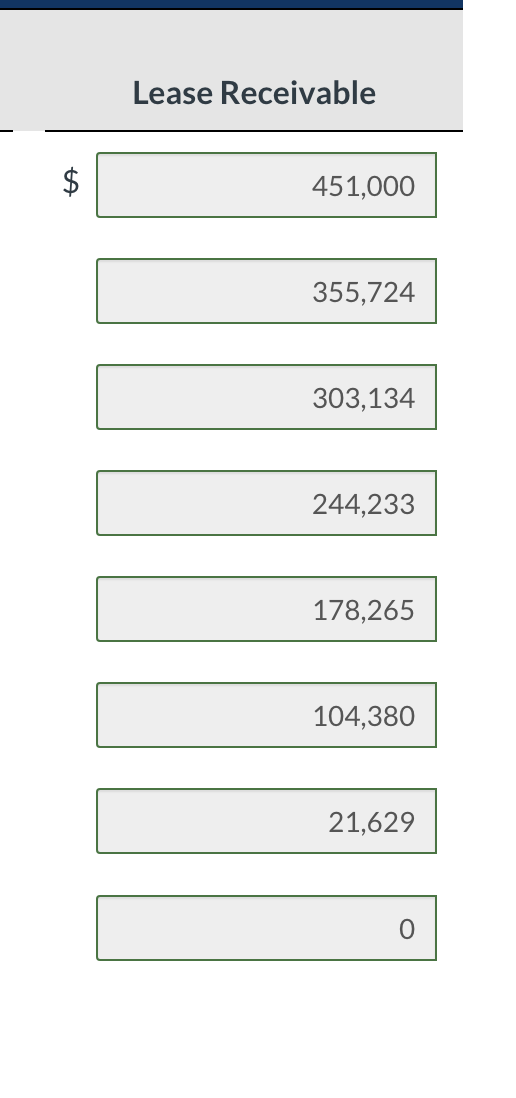

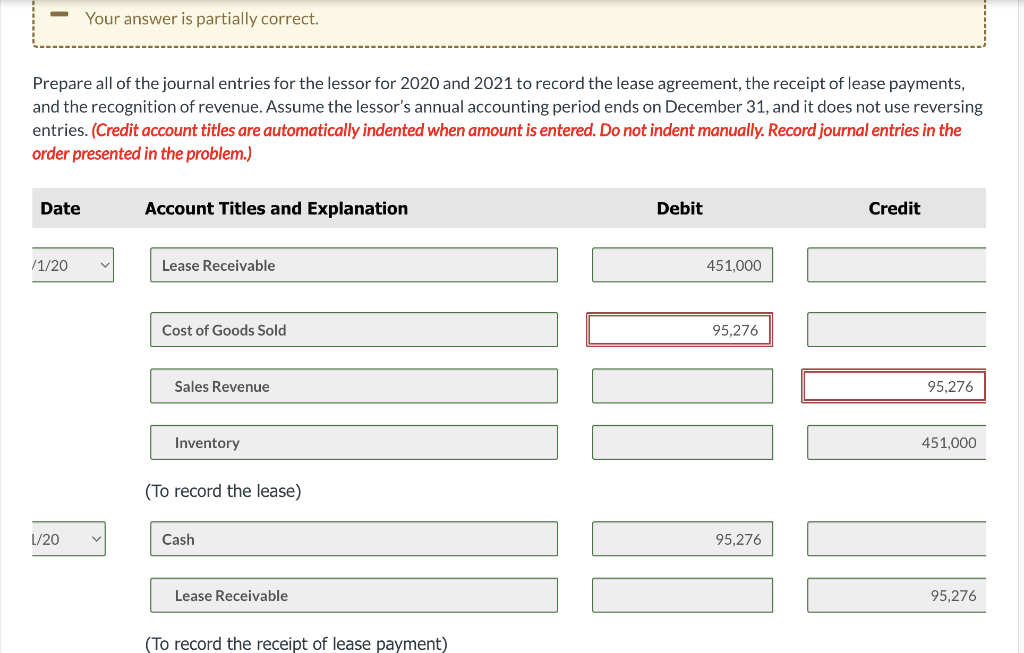

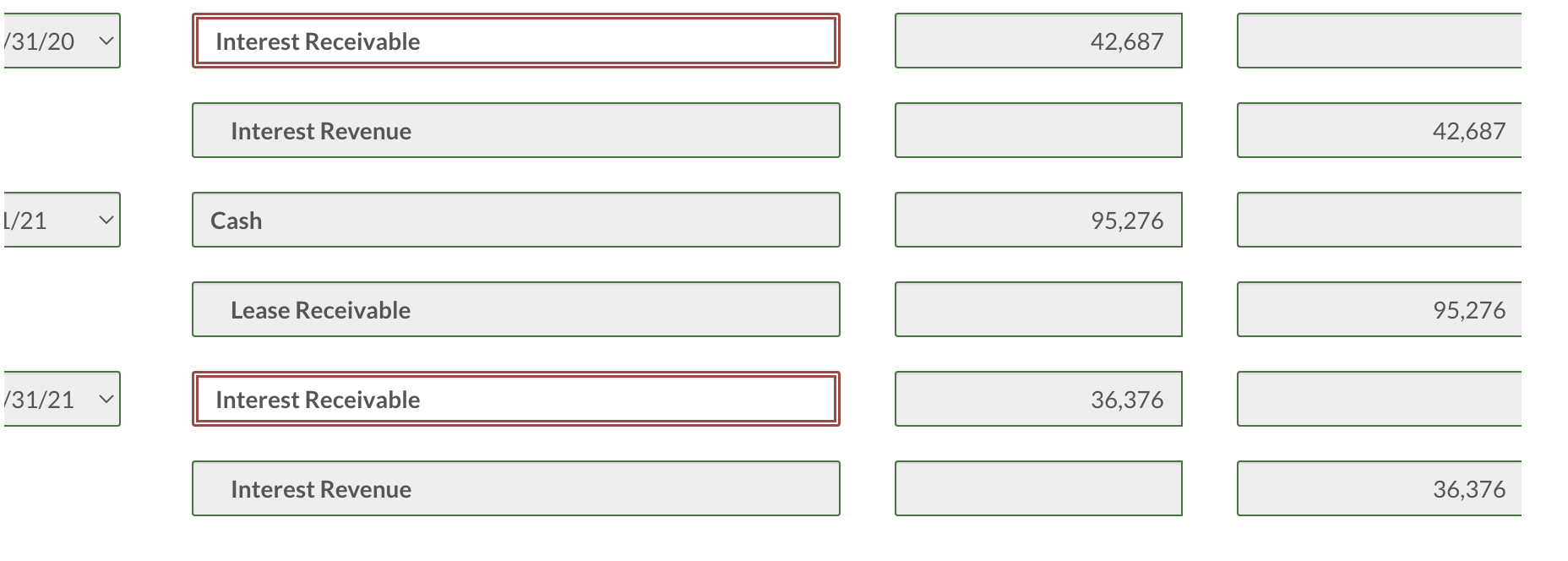

Prepare an amortization schedule that is suitable for the lessor for the lease term. (Round answers to 0 decimal places e.g. 5,275.) MARIN LEASING COMPANY (Lessor) Lease Amortization Schedule Annual Lease Payment Plus URV Interest on Lease Receivable Recovery of Lease Receivable Date 1/1/20 $ $ $ $ 1/1/20 95,276 95,276 1/1/21 95,276 42,687 52,590 1/1/22 95,276 36,376 58,900 1/1/23 95,276 29,308 65,968 1/1/24 95,276 21,392 73,885 1/1/25 95,276 12,526 82,751 12/31/25 24,225 2,596 21,629 595884 $ 144,484 $ 451,000 Lease Receivable $ 451,000 355,724 303,134 244,233 178,265 104,380 21,629 Your answer is partially correct. Prepare all of the journal entries for the lessor for 2020 and 2021 to record the lease agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessor's annual accounting period ends on December 31, and it does not use reversing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit /1/20 Lease Receivable 451,000 Cost of Goods Sold 95,276 Sales Revenue 95,276 Inventory 451,000 (To record the lease) L/20 Cash 95,276 Lease Receivable 95,276 (To record the receipt of lease payment) 131/20 Interest Receivable 42,687 Interest Revenue 42,687 L/21 Cash 95,276 Lease Receivable 95,276 131/21 Interest Receivable 36,376 Interest Revenue 36,376 Prepare an amortization schedule that is suitable for the lessor for the lease term. (Round answers to 0 decimal places e.g. 5,275.) MARIN LEASING COMPANY (Lessor) Lease Amortization Schedule Annual Lease Payment Plus URV Interest on Lease Receivable Recovery of Lease Receivable Date 1/1/20 $ $ $ $ 1/1/20 95,276 95,276 1/1/21 95,276 42,687 52,590 1/1/22 95,276 36,376 58,900 1/1/23 95,276 29,308 65,968 1/1/24 95,276 21,392 73,885 1/1/25 95,276 12,526 82,751 12/31/25 24,225 2,596 21,629 595884 $ 144,484 $ 451,000 Lease Receivable $ 451,000 355,724 303,134 244,233 178,265 104,380 21,629 Your answer is partially correct. Prepare all of the journal entries for the lessor for 2020 and 2021 to record the lease agreement, the receipt of lease payments, and the recognition of revenue. Assume the lessor's annual accounting period ends on December 31, and it does not use reversing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit /1/20 Lease Receivable 451,000 Cost of Goods Sold 95,276 Sales Revenue 95,276 Inventory 451,000 (To record the lease) L/20 Cash 95,276 Lease Receivable 95,276 (To record the receipt of lease payment) 131/20 Interest Receivable 42,687 Interest Revenue 42,687 L/21 Cash 95,276 Lease Receivable 95,276 131/21 Interest Receivable 36,376 Interest Revenue 36,376

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts