Question: PLEASE SOLVE THE YELLOW PART BECAUSE I AM NOT GETTING THE RIGHT ANSWER FOR IT. Kenartha Oil recently paid $498,900 for equipment that will last

PLEASE SOLVE THE YELLOW PART BECAUSE I AM NOT GETTING THE RIGHT ANSWER FOR IT.

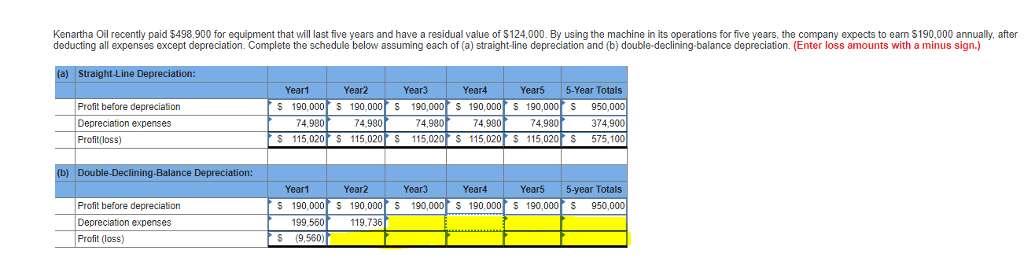

Kenartha Oil recently paid $498,900 for equipment that will last five years and have a residual value of S124,000. By using the machine in its operations for five years, the company expects to eam $190,000 annually, after deducting all expenses except depreciation. Complete the schedule below assuming each of (a) straight-line depreciation and (b) double-declining-balance depreciation. (Enter loss amounts with a minus sign.) Straight-L Year5 5-Year Totals 5 190,000 190,000 S190,000r s 190,000 S 190,000 S 950,000 374,900 $ 115,020 115,020 115,020 115,020 $ 115,020 S 575,100 Year1 Year2 Year3 Year4 Profit before depreciation Depreciation expenses Profit(loss) 74,980 74,980 74,980 74,980 74,980 Double-Declining-Balance Depreciation: Year5 5-year Totals 5 190,000 190,000 S190,000r s 190,000 S 190,000 S 950,000 Year1 Year2 Year3 Year4 Profit before depreciation Depreciation expenses Profit (loss) 199.560 S (9,560) 119,736

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts