Question: Please solve them ASAP .A thumbs up will be given Question 4 Mohammed and Ahmed contributed OMR 75,000 and OMR 75,000 as their share and

Please solve them ASAP .A thumbs up will be given

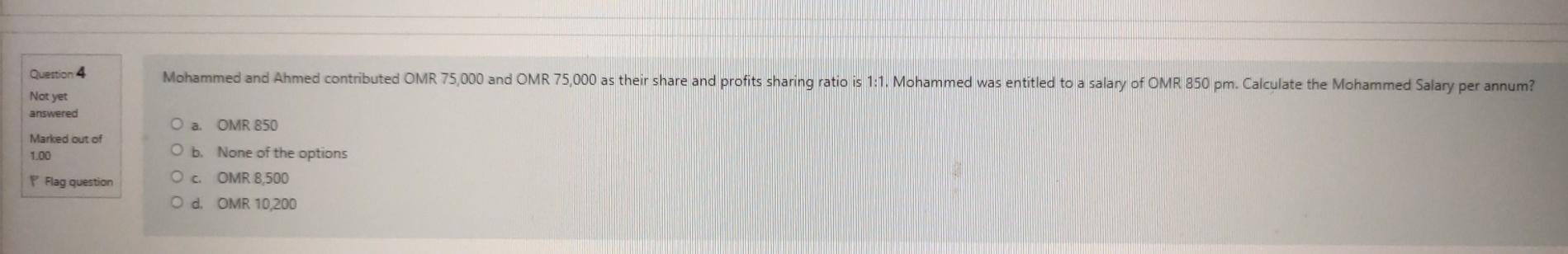

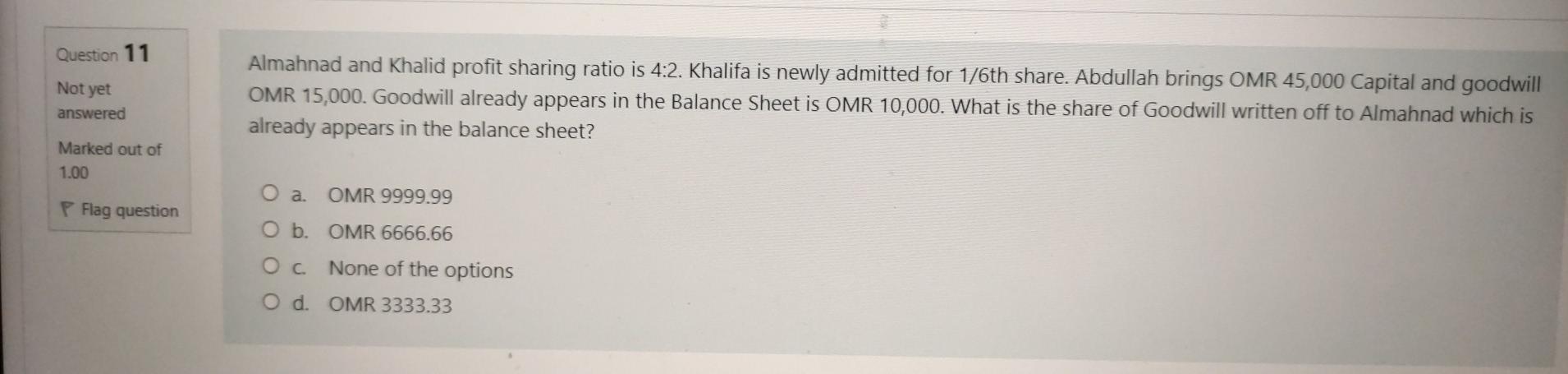

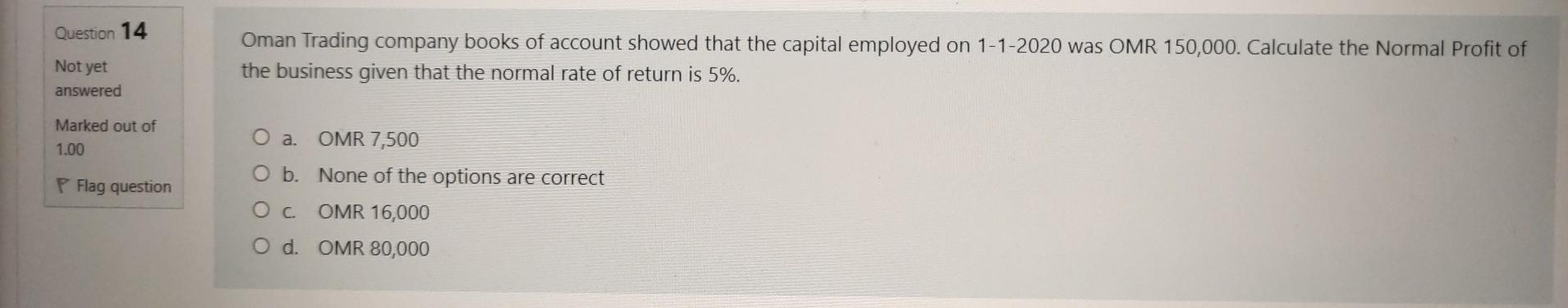

Question 4 Mohammed and Ahmed contributed OMR 75,000 and OMR 75,000 as their share and profits sharing ratio is 1:1. Mohammed was entitled to a salary of OMR 850 pm. Calculate the Mohammed Salary per annum? Not yet answered Marked out of 1.00 OMR 850 O b. None of the options Oc OMR 8,500 Od OMR 10,200 P Flag question Question 11 Not yet Almahnad and Khalid profit sharing ratio is 4:2. Khalifa is newly admitted for 1/6th share. Abdullah brings OMR 45,000 Capital and goodwill OMR 15,000. Goodwill already appears in the Balance Sheet is OMR 10,000. What is the share of Goodwill written off to Almahnad which is already appears in the balance sheet? answered Marked out of 1.00 OMR 9999.99 Flag question O b. OMR 6666.66 . None of the options O d. OMR 3333.33 Question 14 Not yet Oman Trading company books of account showed that the capital employed on 1-1-2020 was OMR 150,000. Calculate the Normal Profit of the business given that the normal rate of return is 5%. answered Marked out of 1.00 P Flag question O a OMR 7,500 O b. None of the options are correct . OMR 16,000 O d. OMR 80,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts