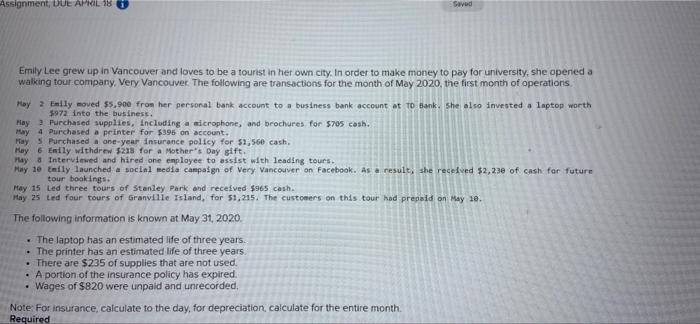

Question: please Solve This As Soon as Possible Assignment, DUE APRIL 18 Saved Emily Lee grew up in Vancouver and loves to be a tourist in

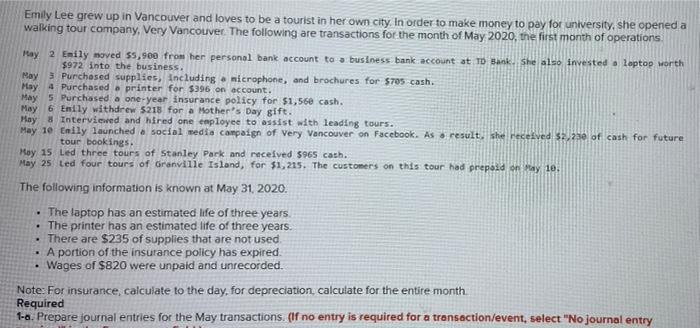

Assignment, DUE APRIL 18 Saved Emily Lee grew up in Vancouver and loves to be a tourist in her own city. In order to make money to pay for university, she opened a walking tour company, Very Vancouver. The following are transactions for the month of May 2020, the first month of operations May 2 Daily moved ss.one from her personal bank account to a business bank account at To Bank. She also invested a laptop worth 3972 Into the business. Hay Purchased supplies, including sicrophone, and brochures for $70s cash. May 4 Purchased a printer for $395 on account. May 3 Purchased a one-year Insurance policy for $1,560 cash May 6 Emily withdrew $213 for a Mother's Day gift. May 8 Interviewed and hired one employee to assist with leading tours. May 10 Emily launched a social media campaign of Very Vancouver on Facebook. As a result, she received $2,238 of cash for future tour bookings May 15 Led three tours of Stanley Park and received $965 cash May 25 led four tours of Granville Island, for 51,215. The customers on this tour hod pressid on May 10. The following information is known at May 31, 2020 The laptop has an estimated life of three years. The printer has an estimated life of three years There are $235 of supplies that are not used. A portion of the insurance policy has expired. Wages of $820 were unpaid and unrecorded. Note: For insurance, calculate to the day, for depreciation calculate for the entire month Required May Emily Lee grew up in Vancouver and loves to be a tourist in her own city. In order to make money to pay for university, she opened a walking tour company, Very Vancouver. The following are transactions for the month of May 2020, the first month of operations. Hay 2 Emily moved 55,900 from her personal bank account to a business bank account at TD Bank. She also invested a laptop worth $972 into the business. Purchased supplies, including microphone, and brochures for 3705 cash. May 4 Purchased a printer for $396 on account. May 5 Purchased a one-year insurance policy for $1,560 cash. May 6 Enlly withdrew 5218 for a Mother's Day gift. May Interviewed and hired one employee to assist with leading tours. May 10 Emily launched a social media campaign of Very Vancouver on Facebook. As o result, she received 3230 of cash for future tour bookings. May 15 Led three tours of Stanley Park and received 5965 cash. May 25 led four tours of Granville Island, for $1,215. The customers on this tour had prepaid ory 10 The following information is known at May 31 2020. The laptop has an estimated life of three years The printer has an estimated life of three years. There are $235 of supplies that are not used A portion of the insurance policy has expired. Wages of $820 were unpaid and unrecorded. Note: For insurance calculate to the day, for depreciation calculate for the entire month Required 1-o. Prepare journal entries for the May transactions. (If no entry is required for a transaction/event, select "No journal entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts