Question: PLEASE SOLVE THIS IN SPREADSHEET (EXCEL), TAKE SCREENSHOT OR COPY-PASTE THE EXCEL FILE WITH THE CELL REFERENCES AND FORMULA AND DO NOT SOLVE IT BY

PLEASE SOLVE THIS IN SPREADSHEET (EXCEL), TAKE SCREENSHOT OR COPY-PASTE THE EXCEL FILE WITH THE CELL REFERENCES AND FORMULA AND DO NOT SOLVE IT BY PAPER AND HAND. THANKS.

Question.) Refer to the chapter opener and Example 7-14. As an alternative to the coal-fired plant, PennCo could construct an 800 MW natural gasfired plant. This plant would require the same initial investment of $1.12 billion dollars to be depreciated over its 30-year life using the SL method with SV30=0. The capacity factor estimate of the plant would still be 80%, but the efficiency of the natural gasfired plant would be 40%. The annual operating and maintenance expense is expected to be $0.01 per kWh. The cost of natural gas is $8.00 per million Btu and the carbon dioxide tax is $15 per metric ton. Natural gas emits 55 metric tons of carbon dioxide per billion Btu produced. The effective income tax rate is 25%, and the after-tax MARR is 10% per year. Based on the after-tax cost of electricity, create a spreadsheet to determine whether PennCo should construct a natural gasfired or coal-fired plant. Note: 1kWh=3,413 Btu.

Chapter Opener -

Example 7-14.

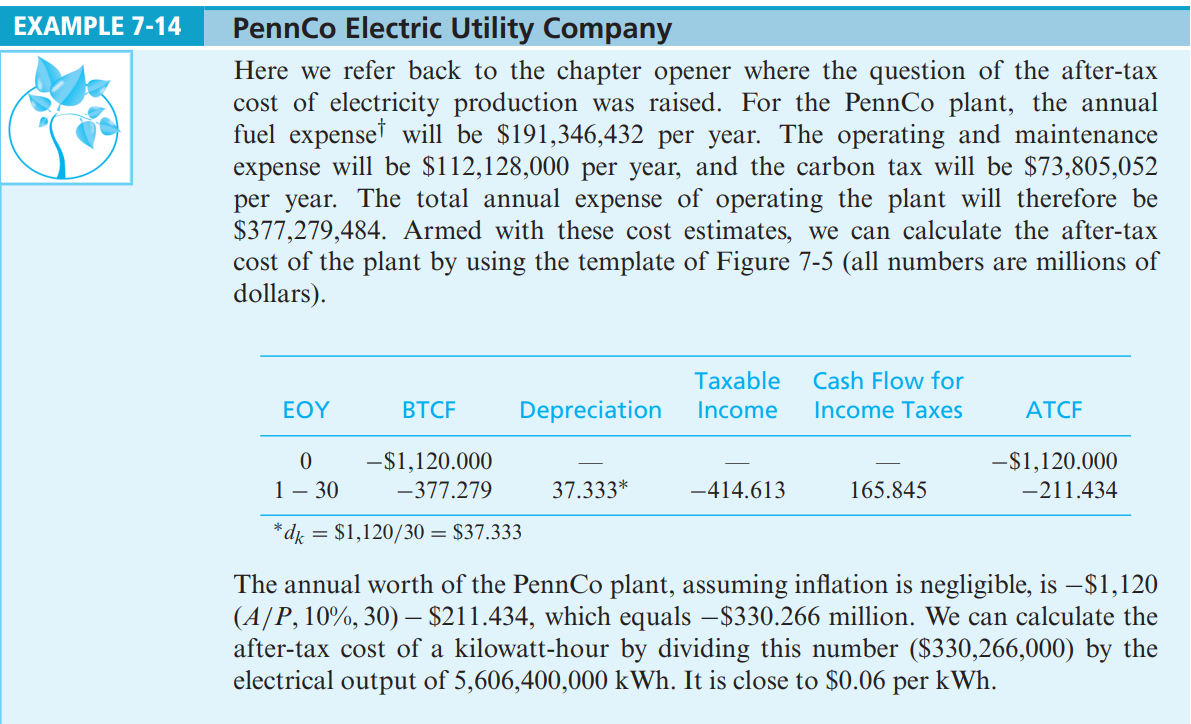

- he PennCo Electric Utility Company is going to construct an 800 megawatt (MW) coal-fired plant that will have a 30-year operating life. The \$1.12-billion construction cost will be depreciated with the straight-line method over 30 years to a terminal book value of zero. Its market value will also be negligible after 30 years. This plant's efficiency will be 35%, its capacity factor is estimated to be 80%, and annual operating and maintenance expenses are expected to be $0.02 per kilowatt hour (kWh). In addition, the cost of coal is estimated to average $3.50 per million Btu, and the tax on carbon dioxide emissions will be $15 per metric ton. Burning coal emits 90 metric tons of CO2 per billion Btu produced. If the effective income tax rate for PennCo is 40%, what is the after-tax cost of electricity per year for this plant? The firm's after-tax minimum attractive rate of return (MARR) is 10% per year. After studying this chapter, you will be able to include the impact of income taxes on engineering projects and answer this question (see Example 7-14). pany Here we refer back to the chapter opener where the question of the after-tax cost of electricity production was raised. For the PennCo plant, the annual fuel expense will be $191,346,432 per year. The operating and maintenance expense will be $112,128,000 per year, and the carbon tax will be $73,805,052 per year. The total annual expense of operating the plant will therefore be $377,279,484. Armed with these cost estimates, we can calculate the after-tax cost of the plant by using the template of Figure 7-5 (all numbers are millions of dollars). The annual worth of the PennCo plant, assuming inflation is negligible, is $1,120 (A/P,10%,30)$211.434, which equals $330.266 million. We can calculate the after-tax cost of a kilowatt-hour by dividing this number ($330,266,000) by the electrical output of 5,606,400,000kWh. It is close to $0.06perkWh. - he PennCo Electric Utility Company is going to construct an 800 megawatt (MW) coal-fired plant that will have a 30-year operating life. The \$1.12-billion construction cost will be depreciated with the straight-line method over 30 years to a terminal book value of zero. Its market value will also be negligible after 30 years. This plant's efficiency will be 35%, its capacity factor is estimated to be 80%, and annual operating and maintenance expenses are expected to be $0.02 per kilowatt hour (kWh). In addition, the cost of coal is estimated to average $3.50 per million Btu, and the tax on carbon dioxide emissions will be $15 per metric ton. Burning coal emits 90 metric tons of CO2 per billion Btu produced. If the effective income tax rate for PennCo is 40%, what is the after-tax cost of electricity per year for this plant? The firm's after-tax minimum attractive rate of return (MARR) is 10% per year. After studying this chapter, you will be able to include the impact of income taxes on engineering projects and answer this question (see Example 7-14). pany Here we refer back to the chapter opener where the question of the after-tax cost of electricity production was raised. For the PennCo plant, the annual fuel expense will be $191,346,432 per year. The operating and maintenance expense will be $112,128,000 per year, and the carbon tax will be $73,805,052 per year. The total annual expense of operating the plant will therefore be $377,279,484. Armed with these cost estimates, we can calculate the after-tax cost of the plant by using the template of Figure 7-5 (all numbers are millions of dollars). The annual worth of the PennCo plant, assuming inflation is negligible, is $1,120 (A/P,10%,30)$211.434, which equals $330.266 million. We can calculate the after-tax cost of a kilowatt-hour by dividing this number ($330,266,000) by the electrical output of 5,606,400,000kWh. It is close to $0.06perkWh

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts