Question: Please solve this problem as soon as possible. Best Bookkeeping Services Limited reported the following information for the first 11 months of the year in

Please solve this problem as soon as possible.

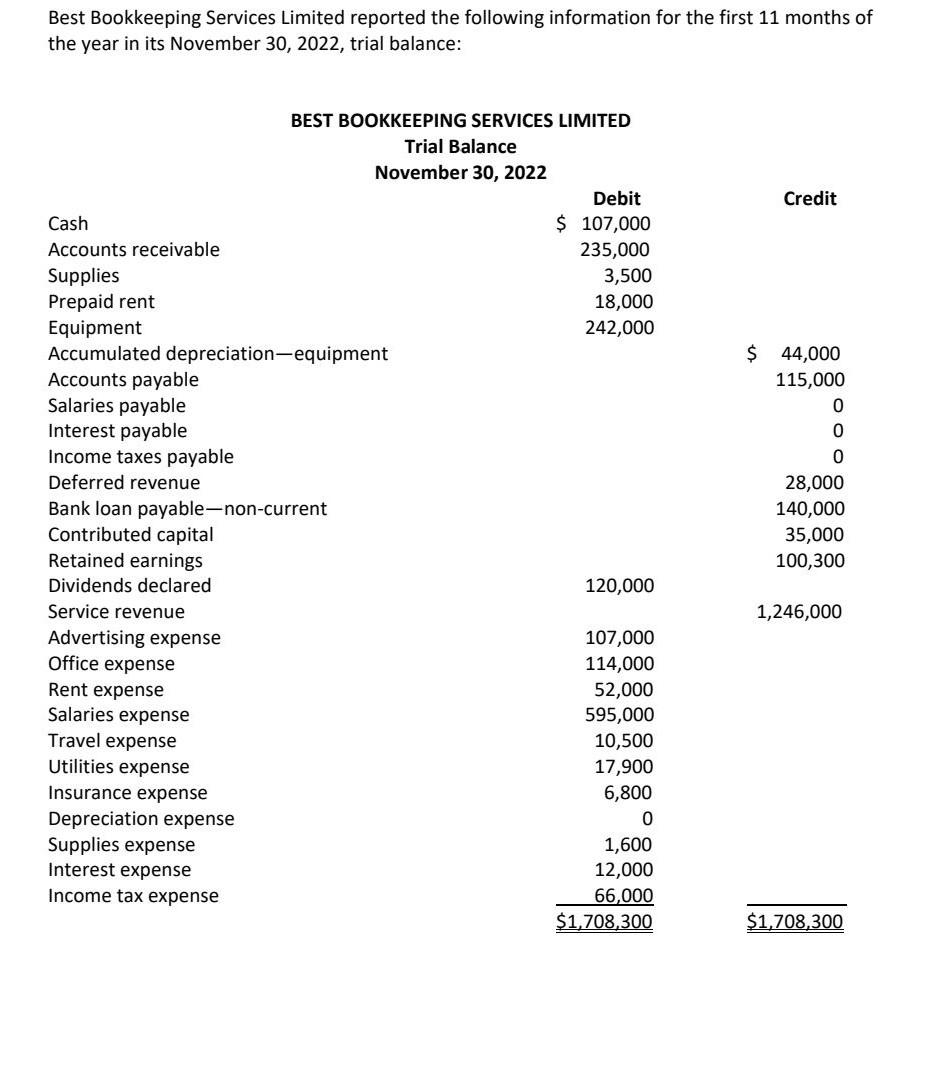

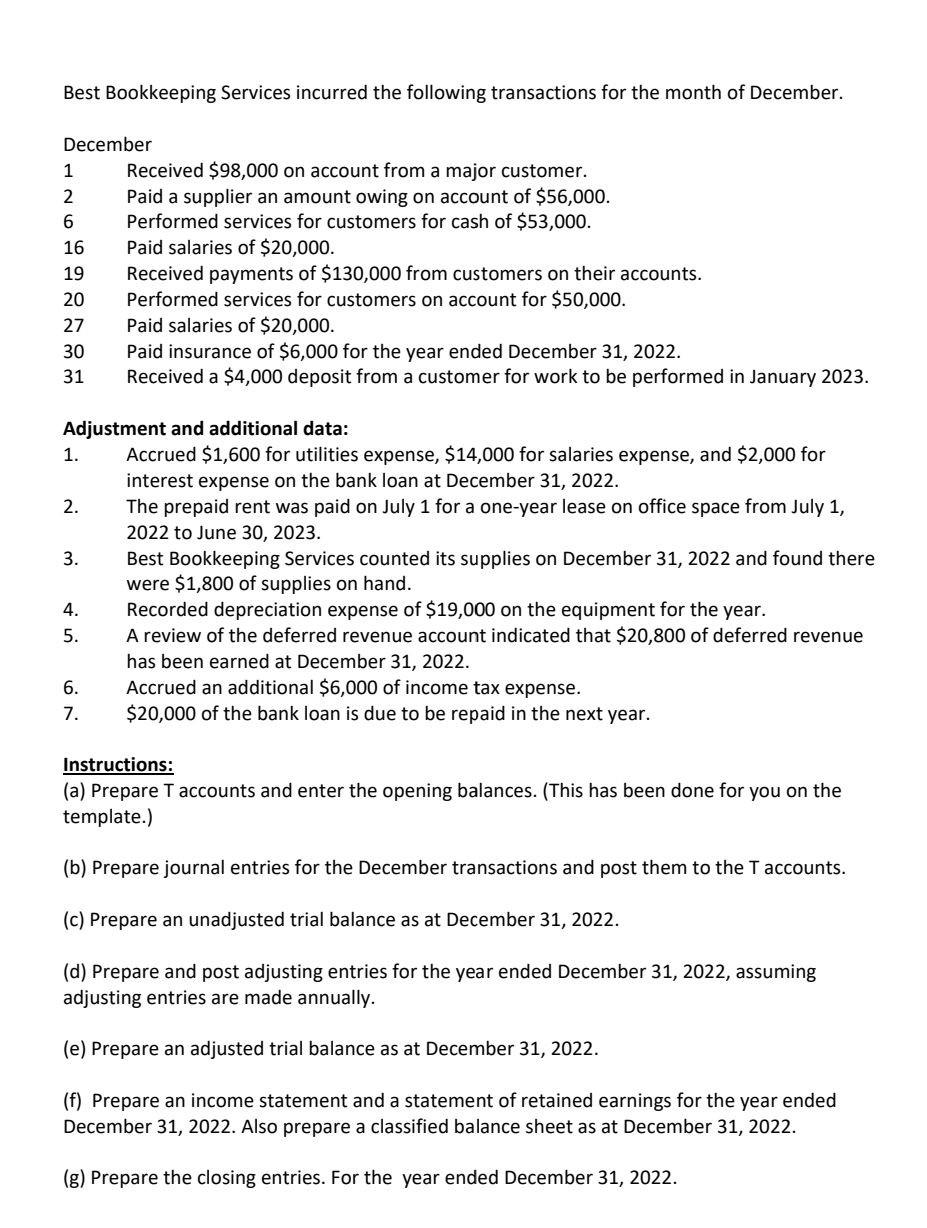

Best Bookkeeping Services Limited reported the following information for the first 11 months of the year in its November 30,2022 , trial balance: Best Bookkeeping Services incurred the following transactions for the month of December. December 126161920273031Received$98,000onaccountfromamajorcustomer.Paidasupplieranamountowingonaccountof$56,000.Performedservicesforcustomersforcashof$53,000.Paidsalariesof$20,000.Receivedpaymentsof$130,000fromcustomersontheiraccounts.Performedservicesforcustomersonaccountfor$50,000.Paidsalariesof$20,000.Paidinsuranceof$6,000fortheyearendedDecember31,2022.Receiveda$4,000depositfromacustomerforworktobeperformedinJanuary2023. Received $98,000 on account from a major customer. Paid a supplier an amount owing on account of $56,000. Performed services for customers for cash of $53,000. Paid salaries of $20,000. Received payments of $130,000 from customers on their accounts. Performed services for customers on account for $50,000. Paid salaries of $20,000. Paid insurance of $6,000 for the year ended December 31, 2022. Received a $4,000 deposit from a customer for work to be performed in January 2023. Adjustment and additional data: 1. Accrued $1,600 for utilities expense, $14,000 for salaries expense, and $2,000 for interest expense on the bank loan at December 31, 2022. 2. The prepaid rent was paid on July 1 for a one-year lease on office space from July 1 , 2022 to June 30, 2023. 3. Best Bookkeeping Services counted its supplies on December 31, 2022 and found there were $1,800 of supplies on hand. 4. Recorded depreciation expense of $19,000 on the equipment for the year. 5. A review of the deferred revenue account indicated that $20,800 of deferred revenue has been earned at December 31, 2022. 6. Accrued an additional $6,000 of income tax expense. 7. $20,000 of the bank loan is due to be repaid in the next year. Instructions: (a) Prepare T accounts and enter the opening balances. (This has been done for you on the template.) (b) Prepare journal entries for the December transactions and post them to the T accounts. (c) Prepare an unadjusted trial balance as at December 31, 2022. (d) Prepare and post adjusting entries for the year ended December 31, 2022, assuming adjusting entries are made annually. (e) Prepare an adjusted trial balance as at December 31, 2022. (f) Prepare an income statement and a statement of retained earnings for the year ended December 31, 2022. Also prepare a classified balance sheet as at December 31, 2022. (g) Prepare the closing entries. For the year ended December 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts