Question: Please solve this problem as soon as possible. Thank you 2. Weaver Chocolate Co. expects to earn $3.50 per share during the current year, its

Please solve this problem as soon as possible. Thank you

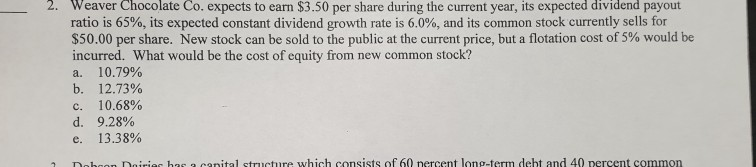

2. Weaver Chocolate Co. expects to earn $3.50 per share during the current year, its expected dividend payout ratio is 65%, its expected constant dividend growth rate is 6.0%, and its common stock currently sells for $50.00 per share. New stock can be sold to the public at the current price, but a flotation cost of 5% would be incurred. What would be the cost of equity from new common stock? a. 10.79% b. 12.73% c. 10.68% d. 9.28% e. 13.38% s has a canital structure which consists of 60 nercent long-term debt and 40 percent common

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts