Question: please solve this problem CLO 2 Maximum Marks 10 1: Discuss the relations among net income, cash flows from operations, cash flows from investing activities,

please solve this problem

please solve this problem

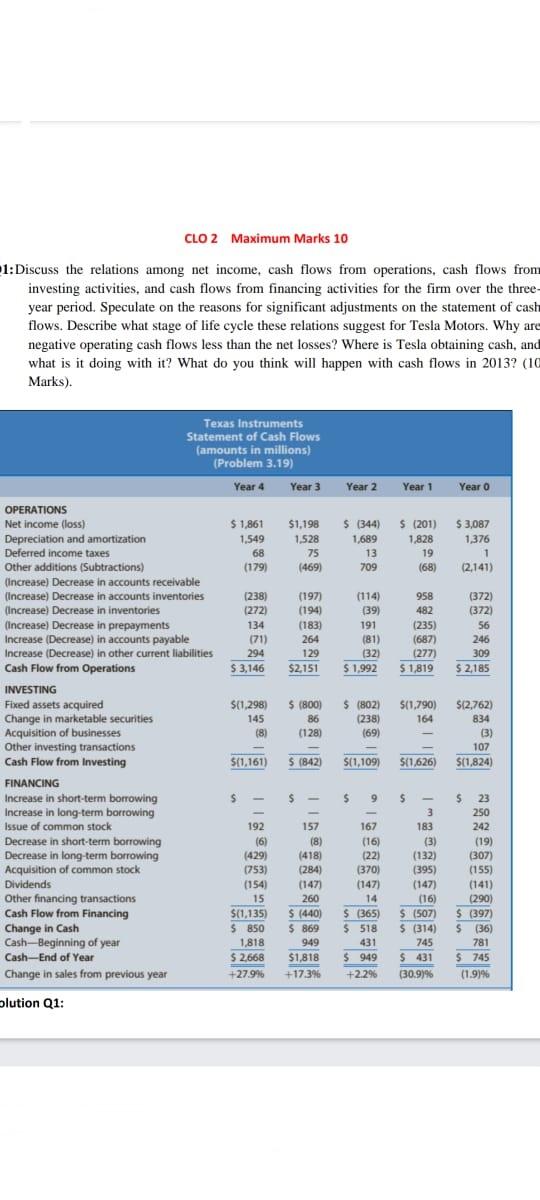

CLO 2 Maximum Marks 10 1: Discuss the relations among net income, cash flows from operations, cash flows from investing activities, and cash flows from financing activities for the firm over the three- year period. Speculate on the reasons for significant adjustments on the statement of cash flows. Describe what stage of life cycle these relations suggest for Tesla Motors. Why are negative operating cash flows less than the net losses? Where is Tesla obtaining cash, and what is it doing with it? What do you think will happen with cash flows in 2013? (10 Marks). Texas Instruments Statement of Cash Flows (amounts in millions) (Problem 3.19) Year 4 Year 3 Year 2 Year 1 Year o $ 3,087 $ 1,861 1,549 68 (179) $1,198 1.528 75 (469) 5 (344) 1,689 13 $ (201) 1,828 19 (68) 1,376 1 (2,141) 709 OPERATIONS Net income (loss) Depreciation and amortization Deferred income taxes Other additions (Subtractions) Increase) Decrease in accounts receivable (Increase) Decrease in accounts inventories Increase) Decrease in inventories (Increase) Decrease in prepayments Increase (Decrease) in accounts payable Increase (Decrease) in other current liabilities Cash Flow from Operations 958 (114) (39) (372) (372) 482 (238) (272) 134 (71) 294 (197) (194) (183) 264 191 56 246 (81) (32) (235) (687) (277) $ 1,819 129 309 $ 3,146 $2,151 $ 1,992 $ 2,185 INVESTING Fixed assets acquired Change in marketable securities Acquisition of businesses Other investing transactions Cash Flow from Investing $11,298) 145 (8) $ (800) 86 (128) $ (802) (238) (69) $(1,790) 164 $12,762) 834 B) 107 $(1.161) $ (842) $(1,109) $(1,626) $(1,824) $ $ $ 95 $ 23 3 250 167 183 242 FINANCING Increase in short-term borrowing Increase in long-term borrowing Issue of common stock Decrease in short-term borrowing Decrease in long-term borrowing Acquisition of common stock Dividends Other financing transactions Cash Flow from Financing Change in Cash Cash-Beginning of year Cash-End of Year Change in sales from previous year 157 (8) (418) (284) (147) (16) (22) (370) (147) 192 (6) (429) (753) (154) ) 15 $(1,135) $ 850 1818 $ 2,668 260 14 (3) (132) (395) (147) (16) $ (507) $ (314) 745 $ 431 (19) (307) (155) (141) (290) $ (397) $ (36) 781 $ 745 $ (440) $ 869 949 $1,818 +17.39 $ (365) $ 518 431 $ 949 +27.9% +2.2% 30.97% (1.9) blution Q1: CLO 2 Maximum Marks 10 1: Discuss the relations among net income, cash flows from operations, cash flows from investing activities, and cash flows from financing activities for the firm over the three- year period. Speculate on the reasons for significant adjustments on the statement of cash flows. Describe what stage of life cycle these relations suggest for Tesla Motors. Why are negative operating cash flows less than the net losses? Where is Tesla obtaining cash, and what is it doing with it? What do you think will happen with cash flows in 2013? (10 Marks). Texas Instruments Statement of Cash Flows (amounts in millions) (Problem 3.19) Year 4 Year 3 Year 2 Year 1 Year o $ 3,087 $ 1,861 1,549 68 (179) $1,198 1.528 75 (469) 5 (344) 1,689 13 $ (201) 1,828 19 (68) 1,376 1 (2,141) 709 OPERATIONS Net income (loss) Depreciation and amortization Deferred income taxes Other additions (Subtractions) Increase) Decrease in accounts receivable (Increase) Decrease in accounts inventories Increase) Decrease in inventories (Increase) Decrease in prepayments Increase (Decrease) in accounts payable Increase (Decrease) in other current liabilities Cash Flow from Operations 958 (114) (39) (372) (372) 482 (238) (272) 134 (71) 294 (197) (194) (183) 264 191 56 246 (81) (32) (235) (687) (277) $ 1,819 129 309 $ 3,146 $2,151 $ 1,992 $ 2,185 INVESTING Fixed assets acquired Change in marketable securities Acquisition of businesses Other investing transactions Cash Flow from Investing $11,298) 145 (8) $ (800) 86 (128) $ (802) (238) (69) $(1,790) 164 $12,762) 834 B) 107 $(1.161) $ (842) $(1,109) $(1,626) $(1,824) $ $ $ 95 $ 23 3 250 167 183 242 FINANCING Increase in short-term borrowing Increase in long-term borrowing Issue of common stock Decrease in short-term borrowing Decrease in long-term borrowing Acquisition of common stock Dividends Other financing transactions Cash Flow from Financing Change in Cash Cash-Beginning of year Cash-End of Year Change in sales from previous year 157 (8) (418) (284) (147) (16) (22) (370) (147) 192 (6) (429) (753) (154) ) 15 $(1,135) $ 850 1818 $ 2,668 260 14 (3) (132) (395) (147) (16) $ (507) $ (314) 745 $ 431 (19) (307) (155) (141) (290) $ (397) $ (36) 781 $ 745 $ (440) $ 869 949 $1,818 +17.39 $ (365) $ 518 431 $ 949 +27.9% +2.2% 30.97% (1.9) blution Q1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts