Question: Please solve this problem TAX RETURN and follow the direction below! Please solve this problem TAX RETURN and follow the direction below! Please solve this

Please solve this problem TAX RETURN and follow the direction below!

Please solve this problem TAX RETURN and follow the direction below!

Please solve this problem TAX RETURN and follow the direction below!

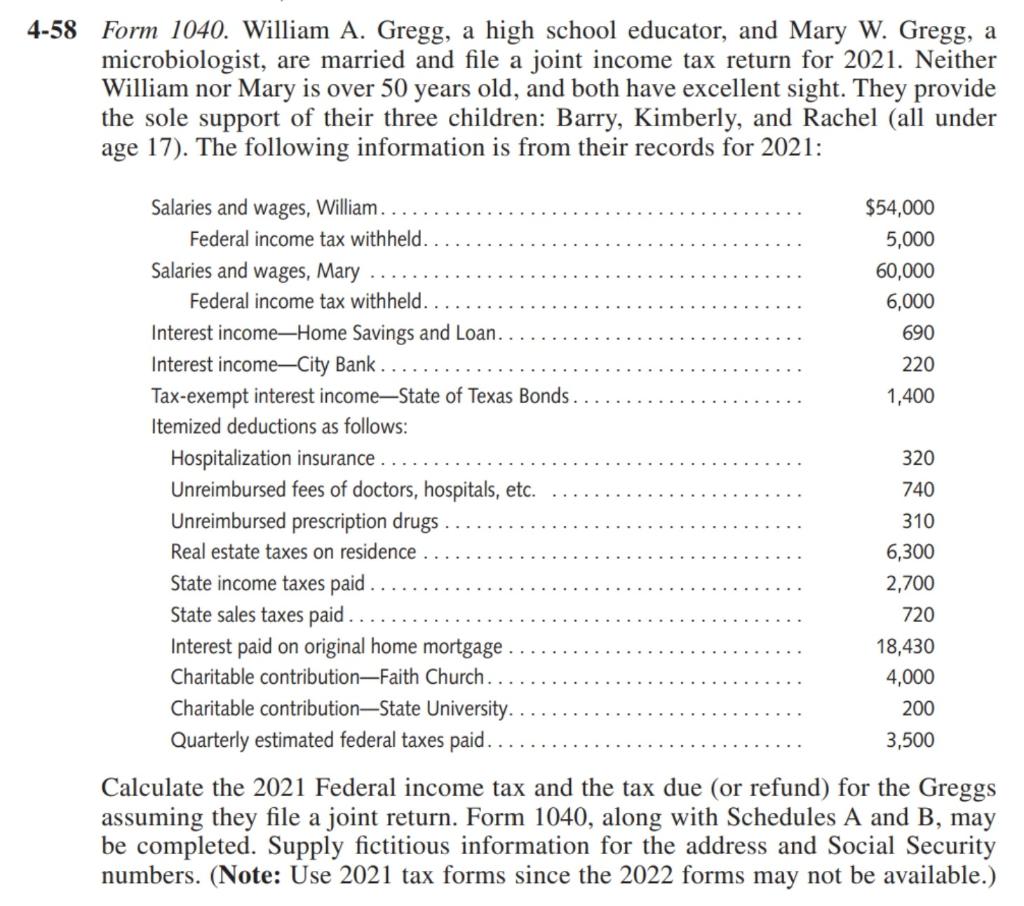

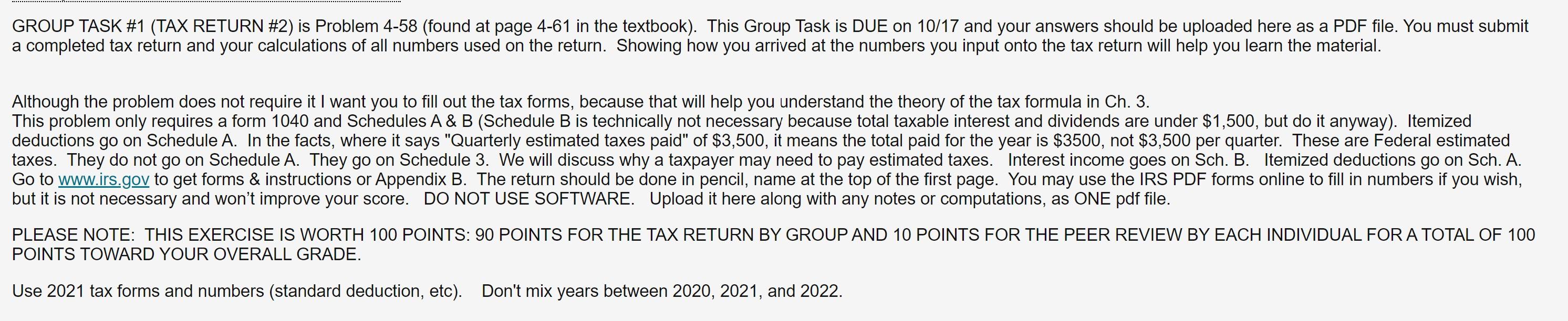

-58 Form 1040. William A. Gregg, a high school educator, and Mary W. Gregg, a microbiologist, are married and file a joint income tax return for 2021. Neither William nor Mary is over 50 years old, and both have excellent sight. They provide the sole support of their three children: Barry, Kimberly, and Rachel (all under age 17). The following information is from their records for 2021 : Calculate the 2021 Federal income tax and the tax due (or refund) for the Greggs assuming they file a joint return. Form 1040, along with Schedules A and B, may be completed. Supply fictitious information for the address and Social Security numbers. (Note: Use 2021 tax forms since the 2022 forms may not be available.) Although the problem does not require it I want you to fill out the tax forms, because that will help you understand the theory of the tax in but it is not necessary and won't improve your score. DO NOT USE SOFTWARE. Upload it here along with any notes or computations, as ONE pdf file. POINTS TOWARD YOUR OVERALL GRADE. Use 2021 tax forms and numbers (standard deduction, etc). Don't mix years between 2020, 2021, and 2022. -58 Form 1040. William A. Gregg, a high school educator, and Mary W. Gregg, a microbiologist, are married and file a joint income tax return for 2021. Neither William nor Mary is over 50 years old, and both have excellent sight. They provide the sole support of their three children: Barry, Kimberly, and Rachel (all under age 17). The following information is from their records for 2021 : Calculate the 2021 Federal income tax and the tax due (or refund) for the Greggs assuming they file a joint return. Form 1040, along with Schedules A and B, may be completed. Supply fictitious information for the address and Social Security numbers. (Note: Use 2021 tax forms since the 2022 forms may not be available.) Although the problem does not require it I want you to fill out the tax forms, because that will help you understand the theory of the tax in but it is not necessary and won't improve your score. DO NOT USE SOFTWARE. Upload it here along with any notes or computations, as ONE pdf file. POINTS TOWARD YOUR OVERALL GRADE. Use 2021 tax forms and numbers (standard deduction, etc). Don't mix years between 2020, 2021, and 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts