Question: Please solve this problem urgently I will upvote thanks for the help advance Question Description In her will, Violet Isaacson (Jeanne's mother) left Jeanne a

Please solve this problem urgently I will upvote thanks for the help advance

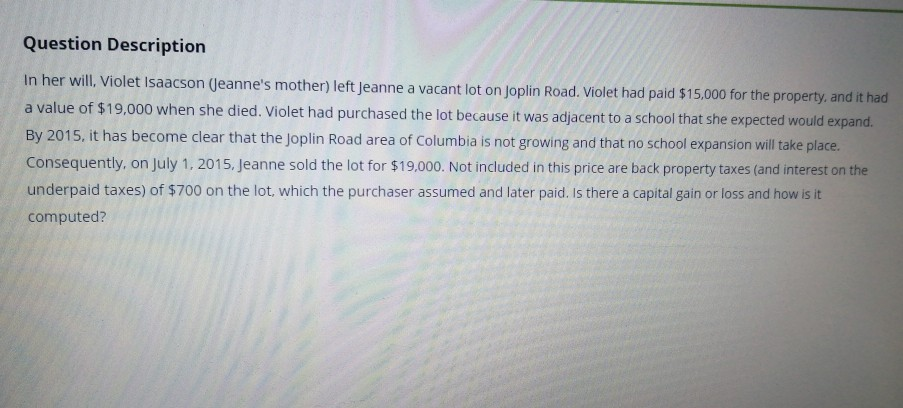

Question Description In her will, Violet Isaacson (Jeanne's mother) left Jeanne a vacant lot on Joplin Road. Violet had paid $15,000 for the property, and it had a value of $19,000 when she died. Violet had purchased the lot because it was adjacent to a school that she expected would expand. By 2015, it has become clear that the Joplin Road area of Columbia is not growing and that no school expansion will take place. Consequently, on July 1, 2015, Jeanne sold the lot for $19,000. Not included in this price are back property taxes (and interest on the underpaid taxes) of $700 on the lot, which the purchaser assumed and later paid. Is there a capital gain or loss and how is it computed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts