Question: Please solve this problem urgently I will upvote thanks for the help advance Please do it atleast D, E, F bits and I will appreciate

Please solve this problem urgently I will upvote thanks for the help advance

Please do it atleast D, E, F bits and I will appreciate if you could do all. Thanks

Please check now do all bits. Thanks

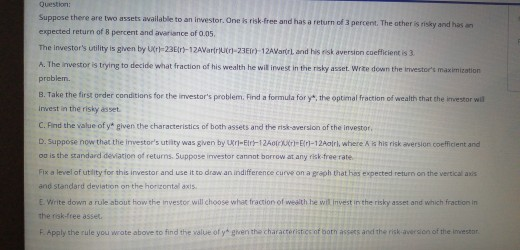

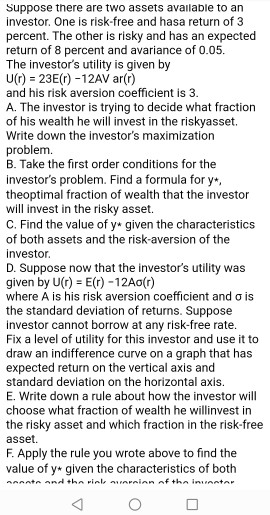

Question: Suppose there are two assets available to an investor. One is risk-free and has a return of a percent. The other is risky and has an expected return of 8 percent and variance of 0.05. The investor's utility is given by U-2351-12AVarrut-23E) 12AVarl, and his risk aversion coefficientis 3 A. The investor is trying to decide what fraction of his wealth he will invest in the risky asset. Write down the investor's maximization problem. B. Take the first order conditions for the investor's problem. Find a formula for y, the optimal fraction of wealth that the investor wil Invest in the risky asset. C. Find the value of a given the characteristics of both assets and the risk-aversion of the investor D. Suppose now that the investor's utility was given by Ur-El-12AXX-12Airl, where A is his risk aversion coefficient and ou is the standard deviation of returns Suppose inwestor cannot borrow at any risk free rate Fix a level of utility for this investor and use it to draw an indifference curve on a graph that has expected return on the vertical axis and standard deviation on the horizontal axis. E. Write down a rule about how the investor will choose what traction of wealth be wil invest in the risky asset and which fraction in the risk-free asset F. Apply the rule you wrote above to find the value of given the characteristics of both assets and the risk version of the investor Suppose there are two assets available to an investor. One is risk-free and hasa return of 3 percent. The other is risky and has an expected return of 8 percent and avariance of 0.05. The investor's utility is given by U(T) = 23E(r) -12AV ar() and his risk aversion coefficient is 3. A. The investor is trying to decide what fraction of his wealth he will invest in the riskyasset. Write down the investor's maximization problem. B. Take the first order conditions for the investor's problem. Find a formula for y*, theoptimal fraction of wealth that the investor will invest in the risky asset. C. Find the value of yu given the characteristics of both assets and the risk-aversion of the investor D. Suppose now that the investor's utility was given by U(T) = E(r) - 12A(r) where A is his risk aversion coefficient and o is the standard deviation of returns. Suppose investor cannot borrow at any risk-free rate. Fix a level of utility for this investor and use it to draw an indifference curve on a graph that has expected return on the vertical axis and standard deviation on the horizontal axis. E. Write down a rule about how the investor will choose what fraction of wealth he willinvest in the risky asset and which fraction in the risk-free asset. F. Apply the rule you wrote above to find the value of y* given the characteristics of both AAAAA and the violarninn of the inventar Question: Suppose there are two assets available to an investor. One is risk-free and has a return of a percent. The other is risky and has an expected return of 8 percent and variance of 0.05. The investor's utility is given by U-2351-12AVarrut-23E) 12AVarl, and his risk aversion coefficientis 3 A. The investor is trying to decide what fraction of his wealth he will invest in the risky asset. Write down the investor's maximization problem. B. Take the first order conditions for the investor's problem. Find a formula for y, the optimal fraction of wealth that the investor wil Invest in the risky asset. C. Find the value of a given the characteristics of both assets and the risk-aversion of the investor D. Suppose now that the investor's utility was given by Ur-El-12AXX-12Airl, where A is his risk aversion coefficient and ou is the standard deviation of returns Suppose inwestor cannot borrow at any risk free rate Fix a level of utility for this investor and use it to draw an indifference curve on a graph that has expected return on the vertical axis and standard deviation on the horizontal axis. E. Write down a rule about how the investor will choose what traction of wealth be wil invest in the risky asset and which fraction in the risk-free asset F. Apply the rule you wrote above to find the value of given the characteristics of both assets and the risk version of the investor Suppose there are two assets available to an investor. One is risk-free and hasa return of 3 percent. The other is risky and has an expected return of 8 percent and avariance of 0.05. The investor's utility is given by U(T) = 23E(r) -12AV ar() and his risk aversion coefficient is 3. A. The investor is trying to decide what fraction of his wealth he will invest in the riskyasset. Write down the investor's maximization problem. B. Take the first order conditions for the investor's problem. Find a formula for y*, theoptimal fraction of wealth that the investor will invest in the risky asset. C. Find the value of yu given the characteristics of both assets and the risk-aversion of the investor D. Suppose now that the investor's utility was given by U(T) = E(r) - 12A(r) where A is his risk aversion coefficient and o is the standard deviation of returns. Suppose investor cannot borrow at any risk-free rate. Fix a level of utility for this investor and use it to draw an indifference curve on a graph that has expected return on the vertical axis and standard deviation on the horizontal axis. E. Write down a rule about how the investor will choose what fraction of wealth he willinvest in the risky asset and which fraction in the risk-free asset. F. Apply the rule you wrote above to find the value of y* given the characteristics of both AAAAA and the violarninn of the inventar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts