Question: Please solve this question for me . THANKS Spring 2019 This is a comprehensive project evaluation problem bringing together much of what you have learned

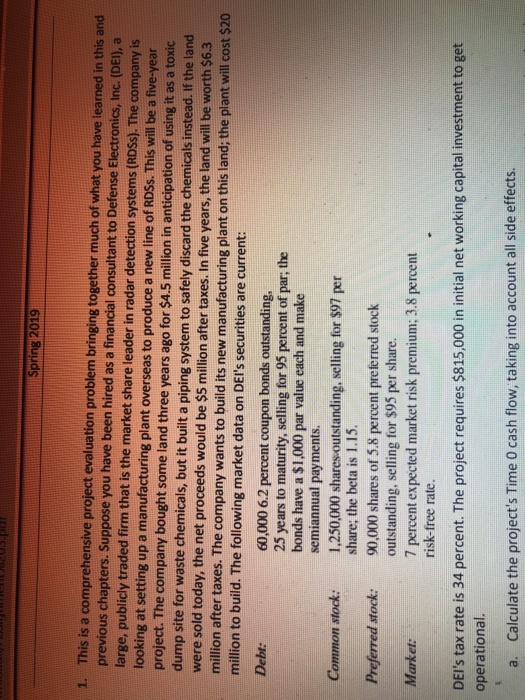

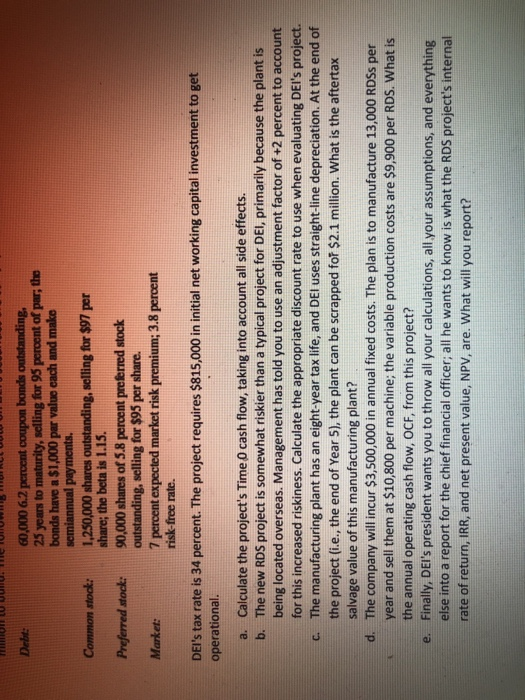

Spring 2019 This is a comprehensive project evaluation problem bringing together much of what you have learned in this and previous chapters. Suppose you have been hired as a financial consultant to Defense Electronics, Inc. (DE), a large, publicly traded firm that is the market share leader in radar detection systems (RDS). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDSs. This will be a five-year project. The company bought some land three years ago for $4.5 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. If the land were sold today, the net proceeds would be $5 million after taxes. In five years, the land will be worth $6.3 million after taxes. The company wants to build its new manufacturing plant on this land; the plant will cost $20 million to build. The following market data on DEI's securities are current: 1. 60,000 6.2 percent coupon bonds outstanding 25 years to maturity, selling for 95 percent of par, the bonds have a $1,000 par value each and make semiannual payments Debt: Common stock: 1.250,000 shares outstanding, selling for $97 per Preferred stock: Market share; the beta is 1.15. 90,000 shares of 5.8 percent preferred stock outstanding, selling for $95 per share. 7 percent expected market risk premium; 3.8 percernt risk-free rate. DEI's tax rate is 34 percent. The project requires $815,000 in initial net working capital investment to get operational a. Calculate the project's Time 0 cash flow, taking into account all side effects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts