Question: Please solve this question step by step Please solve this question step by step Balance Sheet 5300.000 L. LES 34.000 Ant Cashmaster Acce Inventories Prepaid

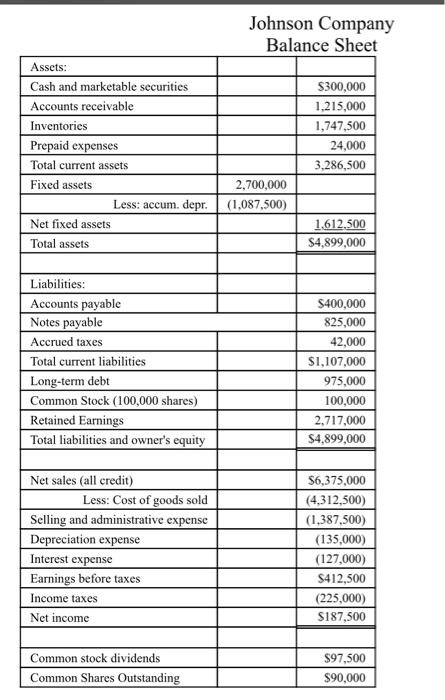

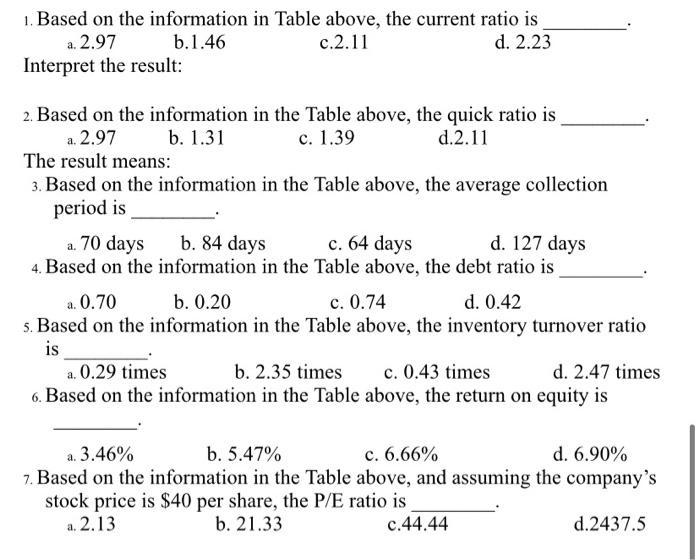

Balance Sheet 5300.000 L. LES 34.000 Ant Cashmaster Acce Inventories Prepaid expres Toulou Fixed Les cum de Nel fixed assets Totals 2.700.000 100 Se Sa Lilities Accounts payable Notes dhe Accred taxes Total current liabines Lagom del Comme Slock (100.000 st) Retained anings Totallibilities and when SL1000 100 2711 . 13.00 230 195.000 Netsales call credit Les Cost of goods wild Selling and administrative expense Dec Interesse Faming before Income Neli 5411 ST Common stock dividende Comme Shares Outstanding 599.00 SO Based on the information in Table above, the current ratio is -2.97 b.1.46 c.2.11 4. 2.23 Interpret the result 2. Based on the information in the Table above, the quick ratio is 2.97 b. 1.31 c. 1.39 d.2.11 The result means: Based on the information in the Table above, the average collection period is 270 days b. 84 days c. 64 days d. 127 days 4 Based on the information in the Table above, the debt ratio is 20.70 c. 0.74 d. 0.42 Based on the information in the Table above, the inventory turnover ratio .0.29 times b. 2.35 times C. 0.43 times d. 2.47 times 6. Based on the information in the Table above, the return on equity is b. 0.20 is . 3,46% b. 5.47% c. 6,66% d. 6.90% 7. Based on the information in the Table above, and assuming the company's stock price is $40 per share, the P/E ratio is 22.13 b. 21.33 c.44.44 d. 2437.5 Johnson Company Balance Sheet Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets $300,000 1,215,000 1,747,500 24,000 3,286,500 2,700,000 (1,087,500) 1.612.500 $4,899,000 Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Common Stock (100,000 shares) Retained Earnings Total liabilities and owner's equity $400,000 825,000 42,000 $1,107,000 975,000 100,000 2,717,000 $4.899,000 Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income $6,375,000 (4,312,500) (1,387,500) (135,000) (127,000) $412,500 (225,000) $187,500 Common stock dividends Common Shares Outstanding $97,500 $90,000 1. Based on the information in Table above, the current ratio is a. 2.97 b.1.46 c.2.11 d. 2.23 Interpret the result: 2. Based on the information in the Table above, the quick ratio is a. 2.97 b. 1.31 c. 1.39 d.2.11 The result means: 3. Based on the information in the Table above, the average collection period is a. 70 days b. 84 days c. 64 days d. 127 days 4. Based on the information in the Table above, the debt ratio is a. 0.70 b. 0.20 c. 0.74 d. 0.42 s. Based on the information in the Table above, the inventory turnover ratio is a. 0.29 times b. 2.35 times c. 0.43 times d. 2.47 times 6. Based on the information in the Table above, the return on equity is a. 3.46% b. 5.47% c. 6.66% d. 6.90% 7. Based on the information in the Table above, and assuming the company's stock price is $40 per share, the P/E ratio is a. 2.13 b. 21.33 c.44.44 d.2437.5

Step by Step Solution

There are 3 Steps involved in it

Lets solve each question stepbystep based on the Johnson Company Balance Sheet and Income Statement provided 1 Current Ratio ... View full answer

Get step-by-step solutions from verified subject matter experts