Question: please solve this question the time is very short please ASAP PART (A) Marks (5) / Time 20 minutes Nair Company's total current assets, total

please solve this question the time is very short please ASAP

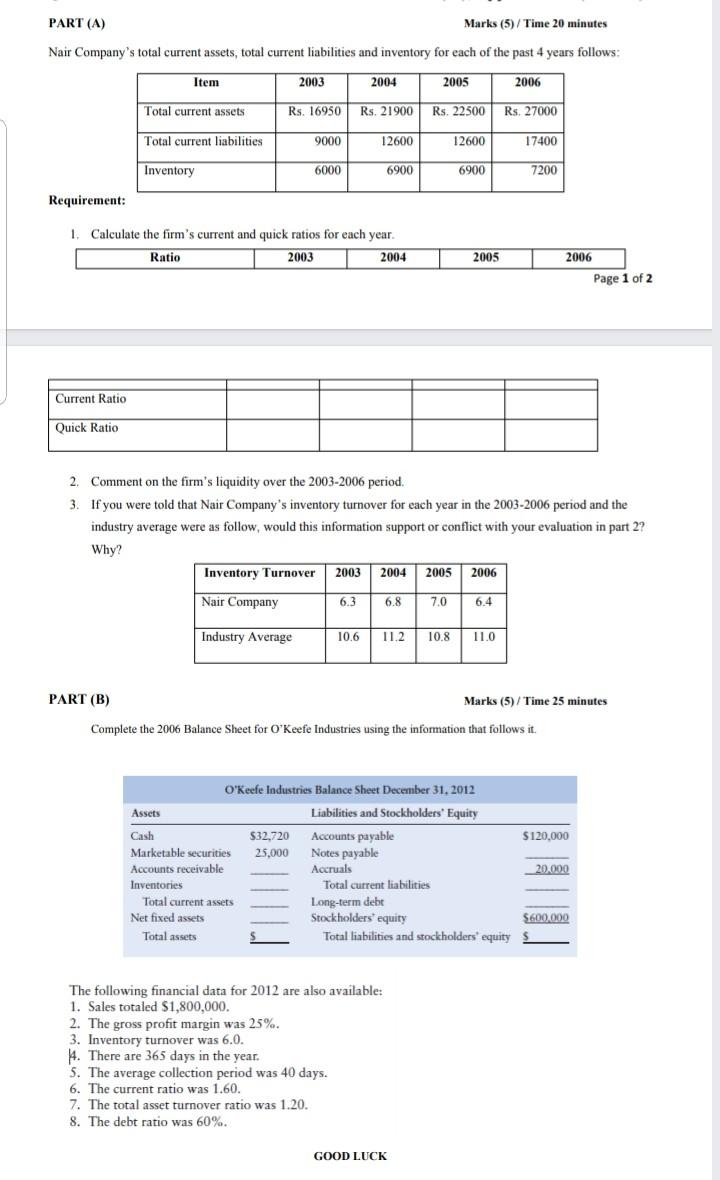

PART (A) Marks (5) / Time 20 minutes Nair Company's total current assets, total current liabilities and inventory for each of the past 4 years follows: Item 2003 2004 2005 2006 Total current assets Rs. 16950 Rs. 21900 Rs. 22500 Rs. 27000 Total current liabilities 9000 12600 12600 17400 Inventory 6000 6900 6900 7200 Requirement: 1 Calculate the firm's current and quick ratios for each year. Ratio 2003 2004 2005 2006 Page 1 of 2 Current Ratio Quick Ratio 2. Comment on the firm's liquidity over the 2003-2006 period. 3. If you were told that Nair Company's inventory turnover for each year in the 2003-2006 period and the industry average were as follow, would this information support or conflict with your evaluation in part 2? Why? Inventory Turnover 2003 2004 2005 2006 Nair Company 6.3 6.8 70 6.4 Industry Average 10.6 11.2 10.8 11.0 PART (B) ) Marks (5)/Time 25 minutes Complete the 2006 Balance Sheet for O'Keefe Industries using the information that follows it. $120,000 O'Keefe Industries Balance Sheet December 31, 2012 Assets Liabilities and Stockholders' Equity Cash $32,720 Accounts payable Marketable securities 25,000 Notes payable Accounts receivable Accruals Inventories Total current liabilities Total current assets Long-term debt Net fixed assets Stockholders' equity Total assets Total liabilities and stockholders' equity 20.000 $600.000 s The following financial data for 2012 are also available: 1. Sales totaled $1,800,000. 2. The gross profit margin was 25%. 3. Inventory turnover was 6.0. 14. There are 365 days in the year. 5. The average collection period was 40 days. 6. The current ratio was 1.60. 7. The total asset turnover ratio was 1.20. 8. The debt ratio was 60%. GOOD LUCK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts