Question: please solve this showing steps and explaining it too. i need help understanding this question Please use the following information to answer the next TWO

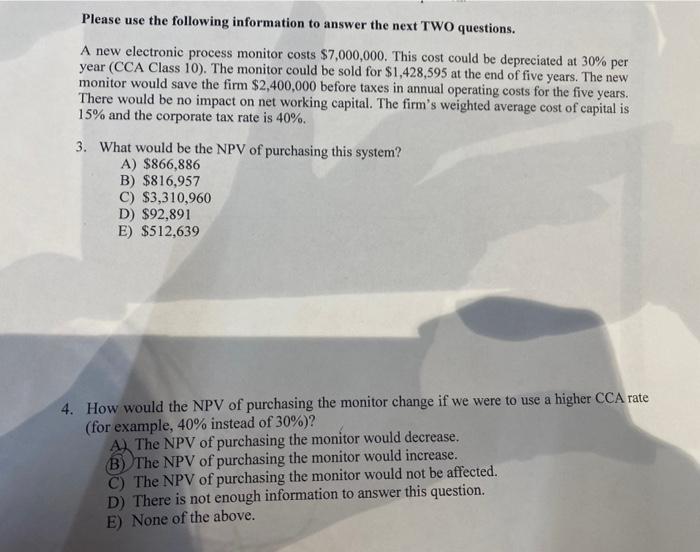

Please use the following information to answer the next TWO questions. A new electronic process monitor costs $7,000,000. This cost could be depreciated at 30% per year (CCA Class 10). The monitor could be sold for $1,428,595 at the end of five years. The new monitor would save the firm $2,400,000 before taxes in annual operating costs for the five years. There would be no impact on net working capital. The firm's weighted average cost of capital is 15% and the corporate tax rate is 40%. 3. What would be the NPV of purchasing this system? A) $866,886 B) $816,957 C) $3,310,960 D) $92,891 E) $512,639 4. How would the NPV of purchasing the monitor change if we were to use a higher CCA rate (for example, 40% instead of 30% )? A) The NPV of purchasing the monitor would decrease. B) The NPV of purchasing the monitor would increase. C) The NPV of purchasing the monitor would not be affected. D) There is not enough information to answer this question. E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts