Question: Please solve this urgent ! I have a graded homework Pivereise 1. (40 points) SWI is considering a project that is expected to generate real

Please solve this urgent !

I have a graded homework

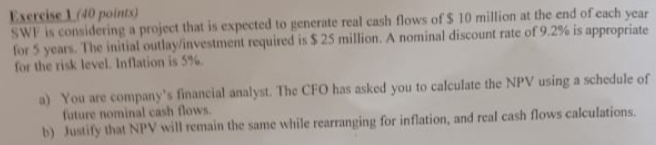

Pivereise 1. (40 points) SWI is considering a project that is expected to generate real cash flows of 510 million at the end of each year for 5 years. The initial outlay/investment required is $25 million. A nominal discount rate of 9.2% is appropriate for the risk level. Inflation is 576 . a) You are company's financial analyst. The CFO has asked you to calculate the NPV using a schedule of toture nominal cash flows. b) Justify that NPV will remain the same while rearranging for inflation, and real cash flows calculations

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock