Question: Please Solve this using MONTE CARLO SIMULATION PLEASE EXPLAIN THIS WITH STEPS IN EXCEL (USING @Risk) File Home Insert Page Layout Formulas Data Review View

Please Solve this using MONTE CARLO SIMULATION PLEASE EXPLAIN THIS WITH STEPS IN EXCEL (USING @Risk)

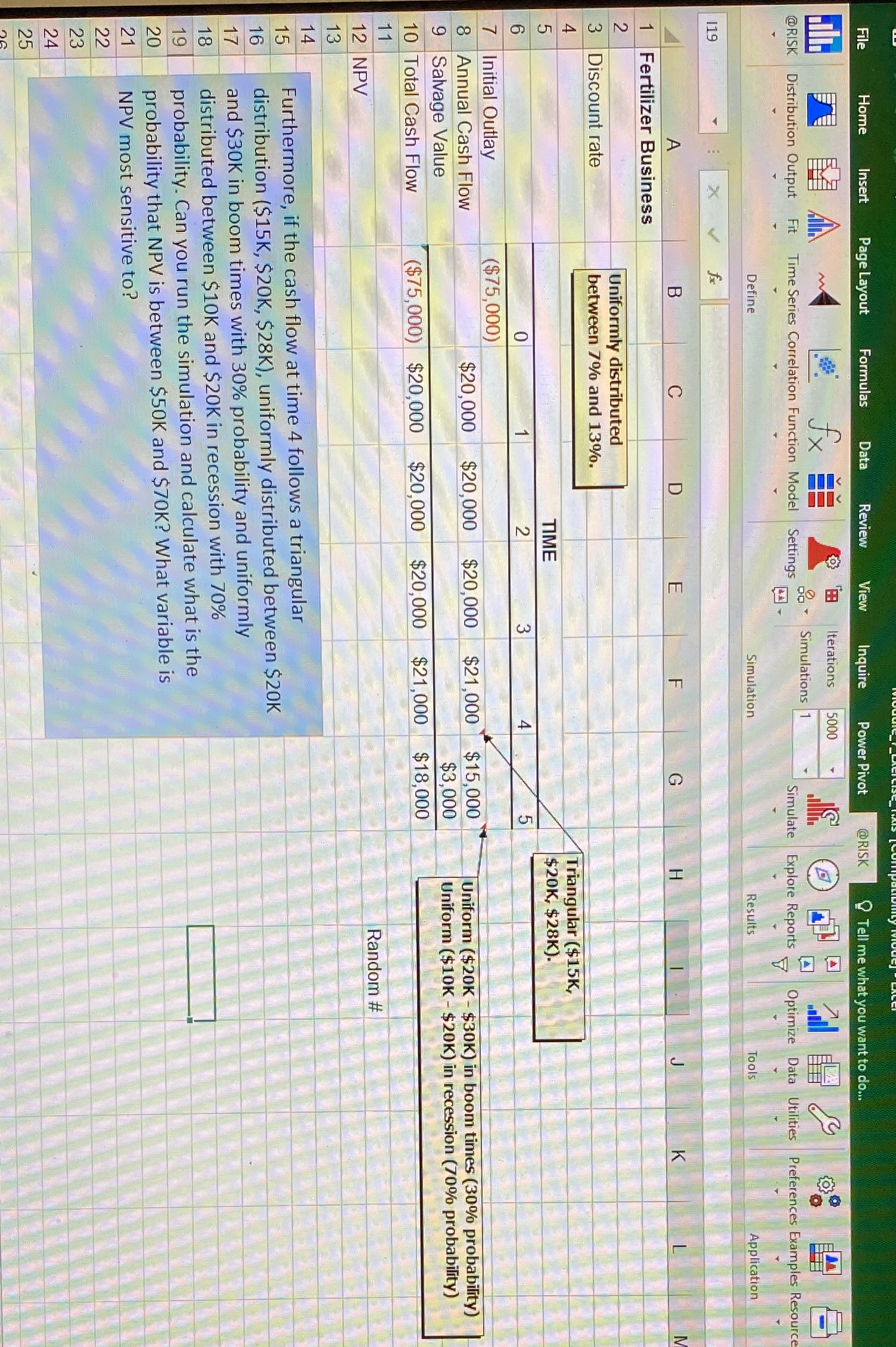

File Home Insert Page Layout Formulas Data Review View Inquire Power Pivot @RISK Tell me what you want to do... M Iterations 5000 III III @RISK Distribution Output Fit Time Series Correlation Function Model Settings Simulations 1 Simulate Explore Reports Optimize Data Utilities Preferences Examples Resource Define Simulation Results Tools Application 19 X LL Fertilizer Business Uniformly distributed Discount rate between 7% and 13%. Triangular ($15K, TIME $20K, $28K)- O Initial Outlay ($75,000) 8 Annual Cash Flow $20,000 $20,000 $20,000 $21,000 $15,000 Uniform ($20K - $30K) in boom times (30% probability) Salvage Value $3,000 Uniform ($10K - $20K) in recession (70% probability) 10 Total Cash Flow $75,000) $20,000 $20,000 $20,000 $21,000 $18,000 12 NPV Random # Furthermore, if the cash flow at time 4 follows a triangular distribution ($15K, $20K, $28K), uniformly distributed between $20K and $30K in boom times with 30% probability and uniformly distributed between $10K and $20K in recession with 70% probability. Can you run the simulation and calculate what is the probability that NPV is between $50K and $70K? What variable is NPV most sensitive to