Question: PLEASE SOLVE USING BA II FINANCE CALCULATOR! Will Rate all Answers! 6. Consider a firm having a target capital structure consisting of 50% common stock,

PLEASE SOLVE USING BA II FINANCE CALCULATOR! Will Rate all Answers!

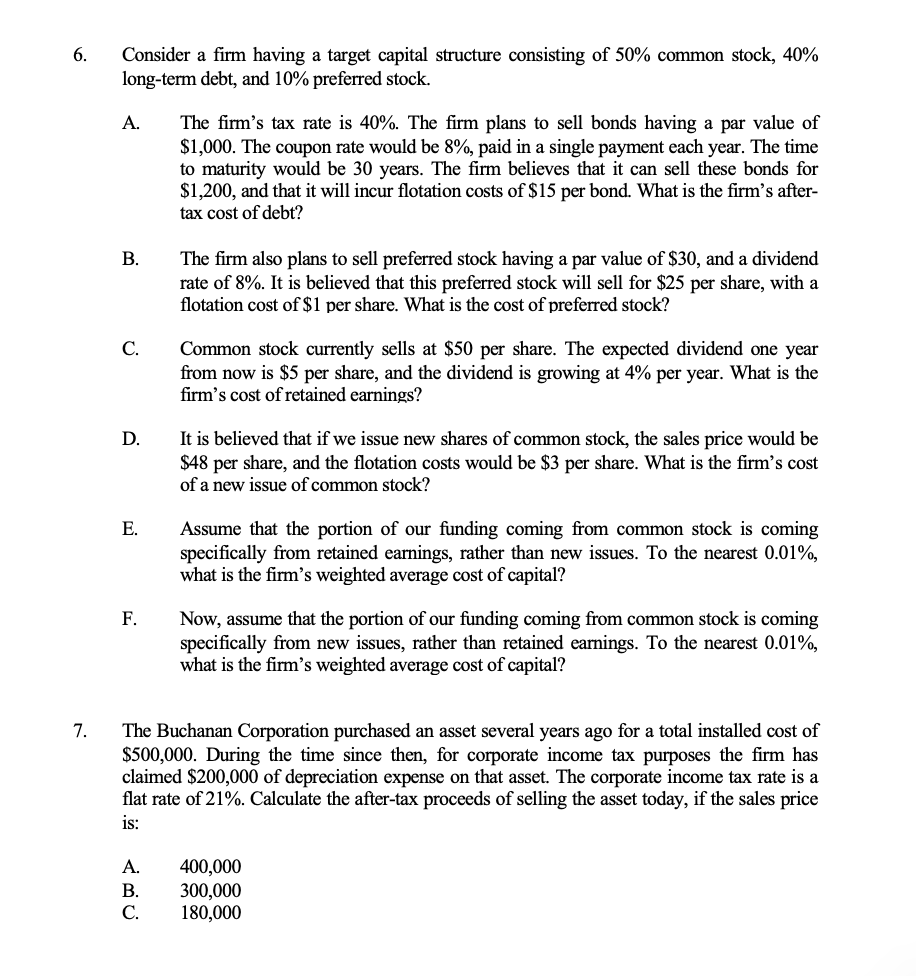

6. Consider a firm having a target capital structure consisting of 50% common stock, 40% long-term debt, and 10% preferred stock. A. The firm's tax rate is 40%. The firm plans to sell bonds having a par value of $1,000. The coupon rate would be 8%, paid in a single payment each year. The time to maturity would be 30 years. The firm believes that it can sell these bonds for $1,200, and that it will incur flotation costs of $15 per bond. What is the firm's after- tax cost of debt? B. The firm also plans to sell preferred stock having a par value of $30, and a dividend rate of 8%. It is believed that this preferred stock will sell for $25 per share, with a flotation cost of $1 per share. What is the cost of preferred stock? C. Common stock currently sells at $50 per share. The expected dividend one year from now is $5 per share, and the dividend is growing at 4% per year. What is the firm's cost of retained earnings? D. It is believed that if we issue new shares of common stock, the sales price would be $48 per share, and the flotation costs would be $3 per share. What is the firm's cost of a new issue of common stock? E. Assume that the portion of our funding coming from common stock is coming specifically from retained earnings, rather than new issues. To the nearest 0.01%, what is the firm's weighted average cost of capital? F. Now, assume that the portion of our funding coming from common stock is coming specifically from new issues, rather than retained earnings. To the nearest 0.01%, what is the firm's weighted average cost of capital? 7. The Buchanan Corporation purchased an asset several years ago for a total installed cost of $500,000. During the time since then, for corporate income tax purposes the firm has claimed $200,000 of depreciation expense on that asset. The corporate income tax rate is a flat rate of 21%. Calculate the after-tax proceeds of selling the asset today, if the sales price is: A. B. C. 400,000 300,000 180,000 6. Consider a firm having a target capital structure consisting of 50% common stock, 40% long-term debt, and 10% preferred stock. A. The firm's tax rate is 40%. The firm plans to sell bonds having a par value of $1,000. The coupon rate would be 8%, paid in a single payment each year. The time to maturity would be 30 years. The firm believes that it can sell these bonds for $1,200, and that it will incur flotation costs of $15 per bond. What is the firm's after- tax cost of debt? B. The firm also plans to sell preferred stock having a par value of $30, and a dividend rate of 8%. It is believed that this preferred stock will sell for $25 per share, with a flotation cost of $1 per share. What is the cost of preferred stock? C. Common stock currently sells at $50 per share. The expected dividend one year from now is $5 per share, and the dividend is growing at 4% per year. What is the firm's cost of retained earnings? D. It is believed that if we issue new shares of common stock, the sales price would be $48 per share, and the flotation costs would be $3 per share. What is the firm's cost of a new issue of common stock? E. Assume that the portion of our funding coming from common stock is coming specifically from retained earnings, rather than new issues. To the nearest 0.01%, what is the firm's weighted average cost of capital? F. Now, assume that the portion of our funding coming from common stock is coming specifically from new issues, rather than retained earnings. To the nearest 0.01%, what is the firm's weighted average cost of capital? 7. The Buchanan Corporation purchased an asset several years ago for a total installed cost of $500,000. During the time since then, for corporate income tax purposes the firm has claimed $200,000 of depreciation expense on that asset. The corporate income tax rate is a flat rate of 21%. Calculate the after-tax proceeds of selling the asset today, if the sales price is: A. B. C. 400,000 300,000 180,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts