Question: PLEASE SOLVE USING BA II FINANCE CALCULATOR! Will Rate all Answers! 1. Consider a firm having preferred stock with a par value of $40, and

PLEASE SOLVE USING BA II FINANCE CALCULATOR! Will Rate all Answers!

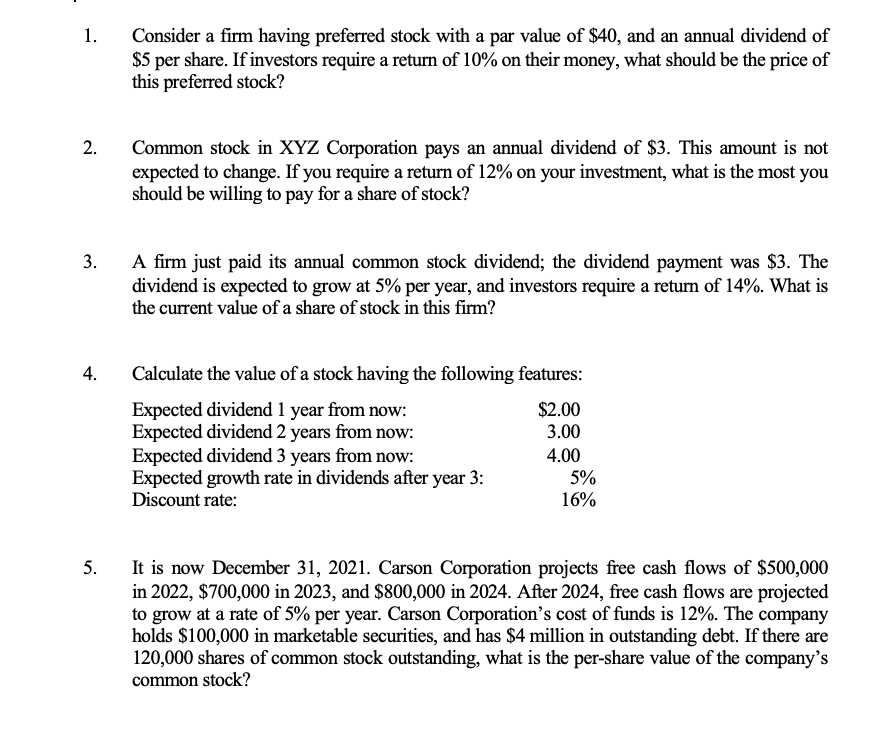

1. Consider a firm having preferred stock with a par value of $40, and an annual dividend of $5 per share. If investors require a return of 10% on their money, what should be the price of this preferred stock? 2. . Common stock in XYZ Corporation pays an annual dividend of $3. This amount is not expected to change. If you require a return of 12% on your investment, what is the most you should be willing to pay for a share of stock? 3. A firm just paid its annual common stock dividend; the dividend payment was $3. The dividend is expected to grow at 5% per year, and investors require a return of 14%. What is the current value of a share of stock in this firm? 4. Calculate the value of a stock having the following features: Expected dividend 1 year from now: $2.00 Expected dividend 2 years from now: 3.00 Expected dividend 3 years from now: 4.00 Expected growth rate in dividends after year 3: 5% Discount rate: 16% 5. It is now December 31, 2021. Carson Corporation projects free cash flows of $500,000 in 2022, $700,000 in 2023, and $800,000 in 2024. After 2024, free cash flows are projected to grow at a rate of 5% per year. Carson Corporation's cost of funds is 12%. The company holds $100,000 in marketable securities, and has $4 million in outstanding debt. If there are 120,000 shares of common stock outstanding, what is the per-share value of the company's common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts