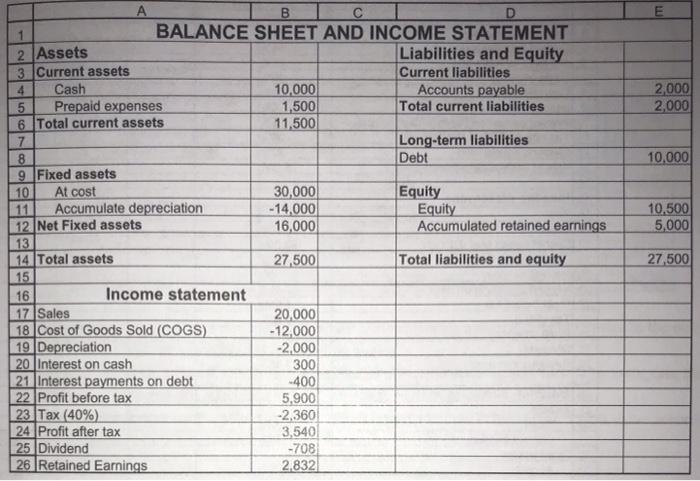

Question: please solve using excel 2,000 2.000 10,000 10,500 5,000 A 1 BALANCE SHEET AND INCOME STATEMENT 2 Assets Liabilities and Equity 3 Current assets Current

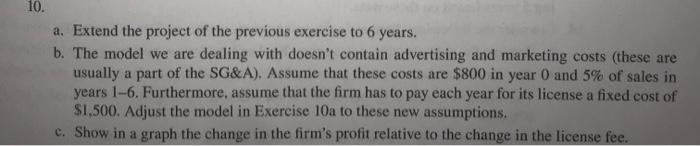

2,000 2.000 10,000 10,500 5,000 A 1 BALANCE SHEET AND INCOME STATEMENT 2 Assets Liabilities and Equity 3 Current assets Current liabilities 4 Cash 10,000 Accounts payable 5 Prepaid expenses 1,500 Total current liabilities 6 Total current assets 11,500 7 Long-term liabilities 8 Debt 9 Fixed assets 10 At cost 30,000 Equity 11 Accumulate depreciation -14,000 Equity 12 Net Fixed assets 16,000 Accumulated retained earnings 13 14 Total assets 27500 Total liabilities and equity 15 16 Income statement 17. Sales 20,000 18 Cost of Goods Sold (COGS) -12.000 19 Depreciation -2,000 20 Interest on cash 300 21 Interest payments on debt -400 22 Profit before tax 5,900 23. Tax (40%) -2.360 24 Profit after tax 3,540 25 Dividend -70B 26 Retained Earnings 2.832 27500 10. a. Extend the project of the previous exercise to 6 years. b. The model we are dealing with doesn't contain advertising and marketing costs (these are usually a part of the SG&A). Assume that these costs are $800 in year 0 and 5% of sales in years 1-6. Furthermore, assume that the firm has to pay each year for its license a fixed cost of $1,500. Adjust the model in Exercise 10a to these new assumptions. c. Show in a graph the change in the firm's profit relative to the change in the license fee. 2,000 2.000 10,000 10,500 5,000 A 1 BALANCE SHEET AND INCOME STATEMENT 2 Assets Liabilities and Equity 3 Current assets Current liabilities 4 Cash 10,000 Accounts payable 5 Prepaid expenses 1,500 Total current liabilities 6 Total current assets 11,500 7 Long-term liabilities 8 Debt 9 Fixed assets 10 At cost 30,000 Equity 11 Accumulate depreciation -14,000 Equity 12 Net Fixed assets 16,000 Accumulated retained earnings 13 14 Total assets 27500 Total liabilities and equity 15 16 Income statement 17. Sales 20,000 18 Cost of Goods Sold (COGS) -12.000 19 Depreciation -2,000 20 Interest on cash 300 21 Interest payments on debt -400 22 Profit before tax 5,900 23. Tax (40%) -2.360 24 Profit after tax 3,540 25 Dividend -70B 26 Retained Earnings 2.832 27500 10. a. Extend the project of the previous exercise to 6 years. b. The model we are dealing with doesn't contain advertising and marketing costs (these are usually a part of the SG&A). Assume that these costs are $800 in year 0 and 5% of sales in years 1-6. Furthermore, assume that the firm has to pay each year for its license a fixed cost of $1,500. Adjust the model in Exercise 10a to these new assumptions. c. Show in a graph the change in the firm's profit relative to the change in the license fee

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts