Question: please solve using EXCEL and post screenshots or comment for email to send file! thank you in advance Mark Sexton and Todd Story, the owners

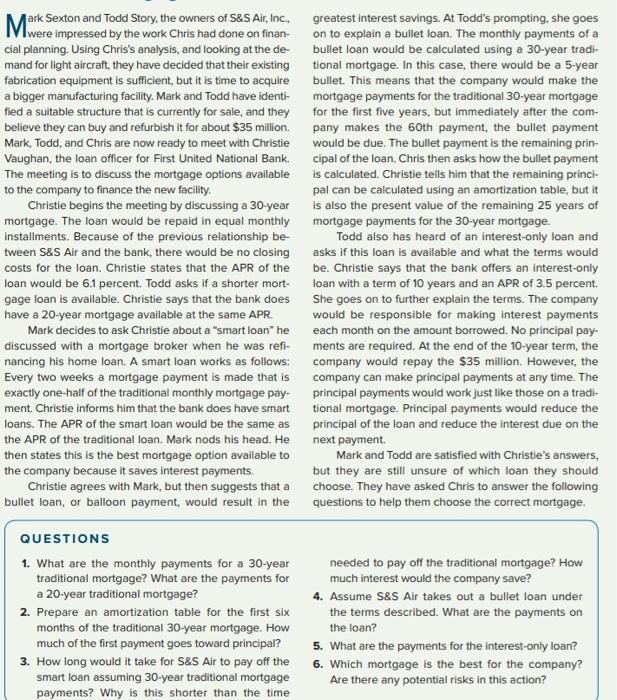

Mark Sexton and Todd Story, the owners of S\&S Air, Inc. greatest interest savings. At Todd's prompting, she goes V were impressed by the work Chris had done on finan- on to explain a bullet loan. The monthly payments of a cial planning. Using Chris's analysis, and looking at the de- bullet loan would be calculated using a 30 -year tradimand for light aircraft, they have decided that their existing tional mortgage. In this case, there would be a 5 -year fabrication equipment is sufficient, but it is time to acquire bullet. This means that the company would make the a bigger manufacturing facility. Mark and Todd have identi- mortgage payments for the traditional 30 -year mortgage fied a suitable structure that is currently for sale, and they for the first five years, but immediately after the com- QUESTIONS 1. What are the monthly payments for a 30 -year needed to pay off the traditional mortgage? How traditional mortgage? What are the payments for much interest would the company save? a 20-year traditional mortgage? 4. Assume S\&S Air takes out a bullet loan under 2. Prepare an amortization table for the first six the terms described. What are the payments on months of the traditional 30-year mortgage. How the loan? much of the first payment goes toward principal? 5. What are the payments for the interest-only loan? 3. How long would it take for S\&S Air to pay off the 6. Which mortgage is the best for the company? smart loan assuming 30-year traditional mortgage payments? Why is this shorter than the time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts