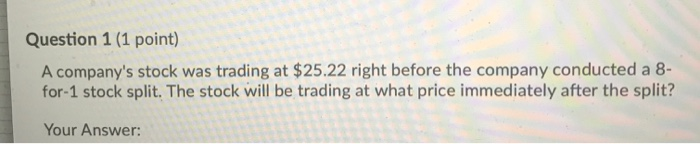

Question: please solve using excel and show formulas pls Question 1 (1 point) A company's stock was trading at $25.22 right before the company conducted a

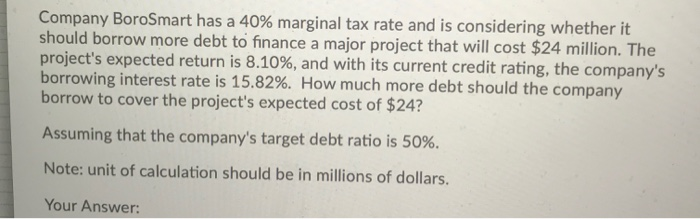

Question 1 (1 point) A company's stock was trading at $25.22 right before the company conducted a 8- for-1 stock split. The stock will be trading at what price immediately after the split? Your Answer: Company BoroSmart has a 40% marginal tax rate and is considering whether it should borrow more debt to finance a major project that will cost $24 million. The project's expected return is 8.10%, and with its current credit rating, the company's borrowing interest rate is 15.82%. How much more debt should the company borrow to cover the project's expected cost of $24? Assuming that the company's target debt ratio is 50%. Note: unit of calculation should be in millions of dollars. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts