Question: Please solve using excel! PART A: What should the coupon rate be, if a company wants to issue 10 year semi annual bonds. The comapny

Please solve using excel!

PART A:

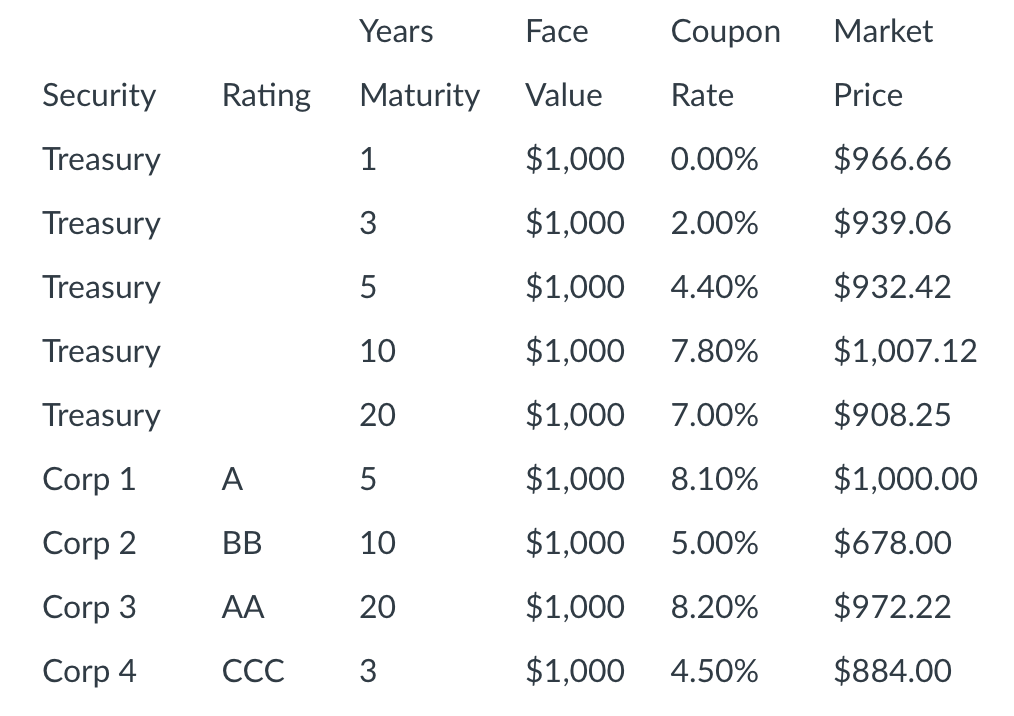

What should the coupon rate be, if a company wants to issue 10 year semi annual bonds. The comapny is CCC rated?

PART B:

A company has issued 5 year BB bonds that pay a semi-annual coupon of 4.4% the company hits financial diffculty and the bonds are downgraded to CCC. What was the change in the price of the bond?

SecurityTreasuryTreasuryTreasuryTreasuryTreasuryCorp1Corp2Corp3Corp4Rating35ABBAACCCYearsMaturity1$1,000$1,0001020510203FaceValue$1,0002.00%4.40%$1,000$1,000$1,000$1,000$1,000$1,000CouponRate0.00%$939.06$932.427.80%7.00%8.10%5.00%8.20%4.50%MarketPrice$966.66$1,007.12$908.25$1,000.00$678.00$972.22$884.00

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock