Question: Please solve using excel. Please show excel formulas (along with columns and rows). I will thumbs up as long as Excel is used, and the

Please solve using excel. Please show excel formulas (along with columns and rows). I will thumbs up as long as Excel is used, and the formula is shown correctly. Thank you!

Please solve using excel. Please show excel formulas (along with columns and rows). I will thumbs up as long as Excel is used, and the formula is shown correctly. Thank you!

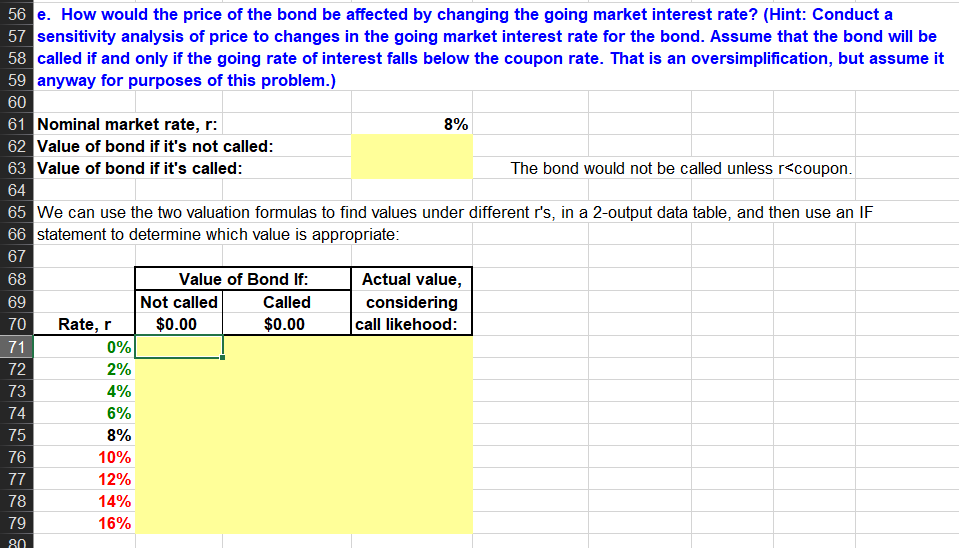

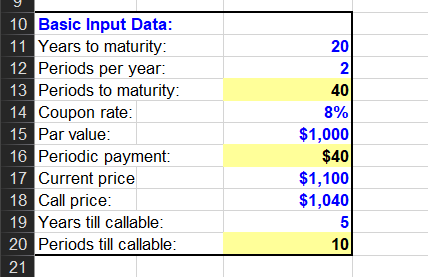

Here is all the data.

56 57 58 59 60 e. How would the price of the bond be affected by changing the going market interest rate? (Hint: Conduct a sensitivity analysis of price to changes in the going market interest rate for the bond. Assume that the bond will be called if and only if the going rate of interest falls below the coupon rate. That is an oversimplification, but assume it anyway for purposes of this problem.) 8% Nominal market rate, r: Value of bond if it's not called 62 6 3 Value of bond if it's called: 64 65 56 statement to determine which value is appropriate 67 68 69 70 The bond would not be called unless rscoupon We can use the two valuation formulas to find values under different r's, in a 2-output data table, and then use an IF Value of Bond If: Called $0.00 Actual value, considering call likehood Not called Rate, r$0.00 72 73 74 75 76 0% 2% 0% 6% 8% 10% 12% 14% 16% 78 79 80 Basic Input Data Years to maturity Periods per year. Periods to maturity Coupon rate Par value Periodic payment. Current price Call price Years till callable Periods till callable 20 2 40 8% $1,000 $40 $1,100 $1,040 20 10 56 57 58 59 60 e. How would the price of the bond be affected by changing the going market interest rate? (Hint: Conduct a sensitivity analysis of price to changes in the going market interest rate for the bond. Assume that the bond will be called if and only if the going rate of interest falls below the coupon rate. That is an oversimplification, but assume it anyway for purposes of this problem.) 8% Nominal market rate, r: Value of bond if it's not called 62 6 3 Value of bond if it's called: 64 65 56 statement to determine which value is appropriate 67 68 69 70 The bond would not be called unless rscoupon We can use the two valuation formulas to find values under different r's, in a 2-output data table, and then use an IF Value of Bond If: Called $0.00 Actual value, considering call likehood Not called Rate, r$0.00 72 73 74 75 76 0% 2% 0% 6% 8% 10% 12% 14% 16% 78 79 80 Basic Input Data Years to maturity Periods per year. Periods to maturity Coupon rate Par value Periodic payment. Current price Call price Years till callable Periods till callable 20 2 40 8% $1,000 $40 $1,100 $1,040 20 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts