Question: Please solve using excel. Please show excel formulas (along with columns and rows). I will thumbs up as long as Excel is used, and the

Please solve using excel. Please show excel formulas (along with columns and rows). I will thumbs up as long as Excel is used, and the formula is shown correctly. Thank you!

Please solve using excel. Please show excel formulas (along with columns and rows). I will thumbs up as long as Excel is used, and the formula is shown correctly. Thank you!

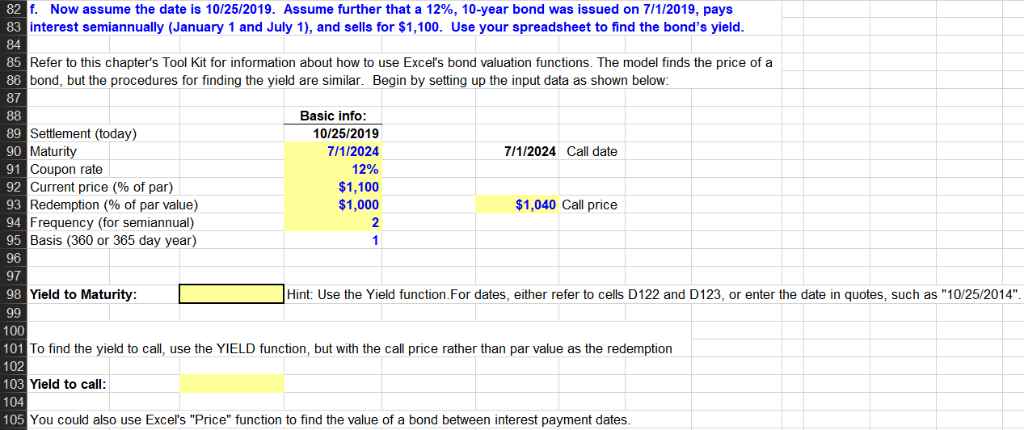

I believe most of my inputs are correct but please let me know if I'm not because I cannot figure out Yield to maturity or Yield to call.

Data for this question.

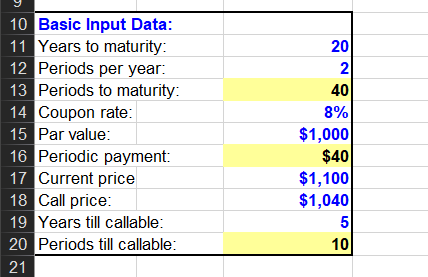

82 8 f. Now assume the date is 10/25/2019. Assume further that a 12%, 10-year bond was issued on 7/1/2019, pays 3interest semiannually (January 1 and July 1), and sells for $1,100. Use your spreadsheet to find the bond's yield 85 86 87 Refer to this chapter's Tool Kit for information about how to use Excel's bond valuation functions. The model finds the price of a bond, but the procedures for finding the yield are similar. Begin by setting up the input data as shown below Basic info Settlement (today) Maturity Coupon rate Current price (% of par) Redemption (% of par value) Frequency (for semiannual) Basis (360 or 365 day year) 10/25/2019 7/1/2024 12% $1,100 $1,000 90 7/1/2024 Call date 93 $1,040 Call price 95 96 97 98 Yield to Maturity: Hint: Use the Yield function.For dates, either refer to cells D122 and D123, or enter the date in quotes, such as "10/25/2014" 100 101 102 To find the yield to call, use the YIELD function, but with the call price rather than par value as the redemption 03 Yield to call: 104 10 5 You could also use Excel's "Price" function to find the value of a bond between interest payment dates Basic Input Data Years to maturity Periods per year. Periods to maturity Coupon rate Par value Periodic payment. Current price Call price Years till callable Periods till callable 20 2 40 8% $1,000 $40 $1,100 $1,040 20 10 82 8 f. Now assume the date is 10/25/2019. Assume further that a 12%, 10-year bond was issued on 7/1/2019, pays 3interest semiannually (January 1 and July 1), and sells for $1,100. Use your spreadsheet to find the bond's yield 85 86 87 Refer to this chapter's Tool Kit for information about how to use Excel's bond valuation functions. The model finds the price of a bond, but the procedures for finding the yield are similar. Begin by setting up the input data as shown below Basic info Settlement (today) Maturity Coupon rate Current price (% of par) Redemption (% of par value) Frequency (for semiannual) Basis (360 or 365 day year) 10/25/2019 7/1/2024 12% $1,100 $1,000 90 7/1/2024 Call date 93 $1,040 Call price 95 96 97 98 Yield to Maturity: Hint: Use the Yield function.For dates, either refer to cells D122 and D123, or enter the date in quotes, such as "10/25/2014" 100 101 102 To find the yield to call, use the YIELD function, but with the call price rather than par value as the redemption 03 Yield to call: 104 10 5 You could also use Excel's "Price" function to find the value of a bond between interest payment dates Basic Input Data Years to maturity Periods per year. Periods to maturity Coupon rate Par value Periodic payment. Current price Call price Years till callable Periods till callable 20 2 40 8% $1,000 $40 $1,100 $1,040 20 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts