Question: Please solve using excel, please show steps and formulas. 9. Assume the demand for the drug Wozac during the current year is 50,000, and assume

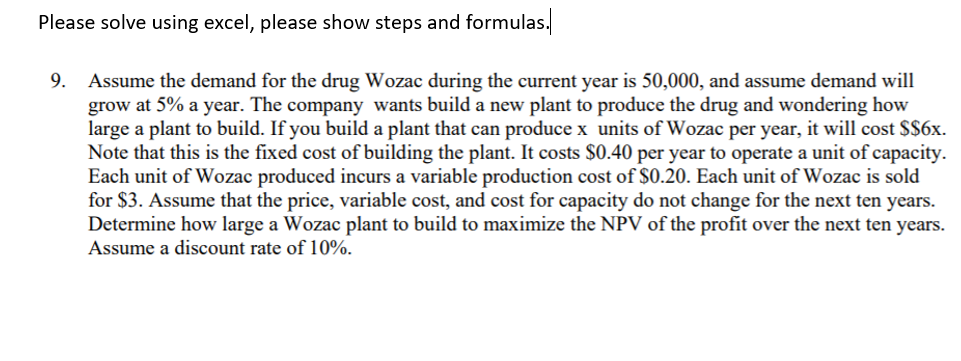

Please solve using excel, please show steps and formulas. 9. Assume the demand for the drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. The company wants build a new plant to produce the drug and wondering how large a plant to build. If you build a plant that can produce x units of Wozac per year, it will cost $$6x. Note that this is the fixed cost of building the plant. It costs $0.40 per year to operate a unit of capacity. Each unit of Wozac produced incurs a variable production cost of $0.20. Each unit of Wozac is sold for $3. Assume that the price, variable cost, and cost for capacity do not change for the next ten years. Determine how large a Wozac plant to build to maximize the NPV of the profit over the next ten years. Assume a discount rate of 10%. Please solve using excel, please show steps and formulas. 9. Assume the demand for the drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. The company wants build a new plant to produce the drug and wondering how large a plant to build. If you build a plant that can produce x units of Wozac per year, it will cost $$6x. Note that this is the fixed cost of building the plant. It costs $0.40 per year to operate a unit of capacity. Each unit of Wozac produced incurs a variable production cost of $0.20. Each unit of Wozac is sold for $3. Assume that the price, variable cost, and cost for capacity do not change for the next ten years. Determine how large a Wozac plant to build to maximize the NPV of the profit over the next ten years. Assume a discount rate of 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts