Question: Please solve using Excel Question 5: Klingon Enterprises is considering opening a retail store selling classic weapons from history. Gowron, the CEO of the company

Please solve using Excel

Please solve using Excel

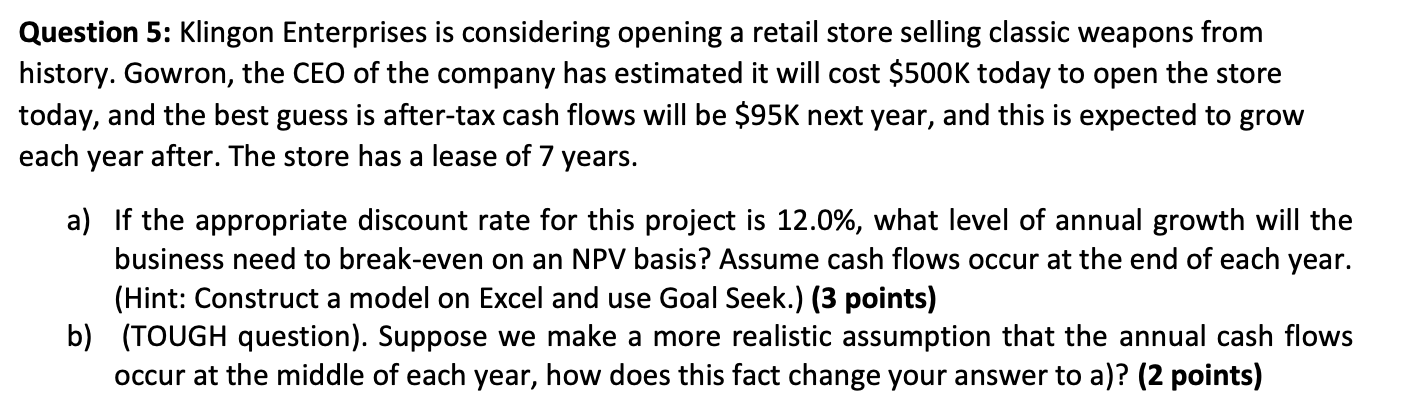

Question 5: Klingon Enterprises is considering opening a retail store selling classic weapons from history. Gowron, the CEO of the company has estimated it will cost $500K today to open the store today, and the best guess is after-tax cash flows will be $95K next year, and this is expected to grow each year after. The store has a lease of 7 years. a) If the appropriate discount rate for this project is 12.0%, what level of annual growth will the business need to break-even on an NPV basis? Assume cash flows occur at the end of each year. (Hint: Construct a model on Excel and use Goal Seek.) (3 points) b) (TOUGH question). Suppose we make a more realistic assumption that the annual cash flows occur at the middle of each year, how does this fact change your answer to a)? (2 points) Question 5: Klingon Enterprises is considering opening a retail store selling classic weapons from history. Gowron, the CEO of the company has estimated it will cost $500K today to open the store today, and the best guess is after-tax cash flows will be $95K next year, and this is expected to grow each year after. The store has a lease of 7 years. a) If the appropriate discount rate for this project is 12.0%, what level of annual growth will the business need to break-even on an NPV basis? Assume cash flows occur at the end of each year. (Hint: Construct a model on Excel and use Goal Seek.) (3 points) b) (TOUGH question). Suppose we make a more realistic assumption that the annual cash flows occur at the middle of each year, how does this fact change your answer to a)? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts