Question: Please solve using excel solver. Thank you for your time and help. A finance major has inherited $200,000 and wants to invest it in a

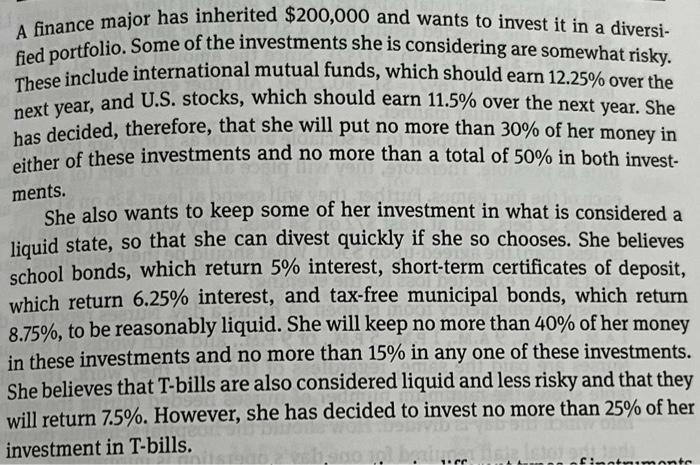

A finance major has inherited $200,000 and wants to invest it in a diversified portfolio. Some of the investments she is considering are somewhat risky. These include international mutual funds, which should earn 12.25% over the next year, and U.S. stocks, which should earn 11.5% over the next year. She has decided, therefore, that she will put no more than 30% of her money in either of these investments and no more than a total of 50% in both investments. She also wants to keep some of her investment in what is considered a liquid state, so that she can divest quickly if she so chooses. She believes school bonds, which return 5% interest, short-term certificates of deposit, which return 6.25% interest, and tax-free municipal bonds, which return 8.75%, to be reasonably liquid. She will keep no more than 40% of her money in these investments and no more than 15% in any one of these investments. She believes that T-bills are also considered liquid and less risky and that they will return 7.5%. However, she has decided to invest no more than 25% of her A finance major has inherited $200,000 and wants to invest it in a diversified portfolio. Some of the investments she is considering are somewhat risky. These include international mutual funds, which should earn 12.25% over the next year, and U.S. stocks, which should earn 11.5% over the next year. She has decided, therefore, that she will put no more than 30% of her money in either of these investments and no more than a total of 50% in both investments. She also wants to keep some of her investment in what is considered a liquid state, so that she can divest quickly if she so chooses. She believes school bonds, which return 5% interest, short-term certificates of deposit, which return 6.25% interest, and tax-free municipal bonds, which return 8.75%, to be reasonably liquid. She will keep no more than 40% of her money in these investments and no more than 15% in any one of these investments. She believes that T-bills are also considered liquid and less risky and that they will return 7.5%. However, she has decided to invest no more than 25% of her

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts