Question: please solve w work Facebook is considering two proposals to overhaul its network infrastructure. The firm has received two bids. The first bid from Huawel

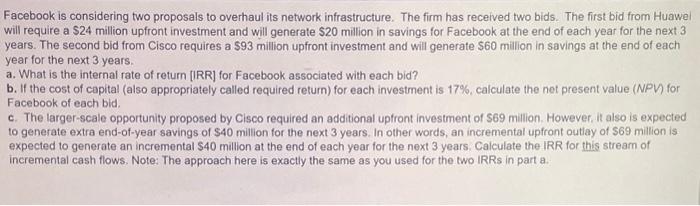

Facebook is considering two proposals to overhaul its network infrastructure. The firm has received two bids. The first bid from Huawel will require a $24 million upfront investment and will generate $20 milion in savings for Facebook at the end of each year for the next 3 years. The second bid from Cisco requires a $93 million upfront investment and will generate $60 million in savings at the end of each year for the next 3 years. a. What is the internal rate of return [IRR] for Facebook associated with each bid? b. If the cost of capital (also appropriately called required return) for each investment is 17%, calculate the net present value (NPV) for Facebook of each bid. c. The larger-scale opportunity proposed by Cisco required an additional upfront investment of $69 million. However, it also is expected to generate extra end-of-year savings of $40 million for the next 3 years. In other words, an incremental upfront outlay of $69 million is expected to generate an incremental $40 million at the end of each year for the next 3 years. Calculate the IRR for this stream of incremental cash flows. Note: The approach here is exactly the same as you used for the two IRRs in part a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts