Question: please solve will upvote immediately if correct (Weighted average cost of capital) The target capital structure for Jowers Manufacturing is 53 percent common stock, 13

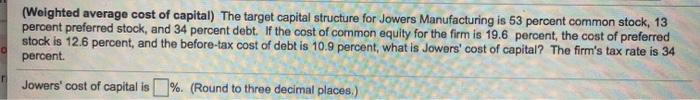

(Weighted average cost of capital) The target capital structure for Jowers Manufacturing is 53 percent common stock, 13 percent preferred stock, and 34 percent debt. If the cost of common equity for the firm is 19.6 percent, the cost of preferred stock is 12.6 percent, and the before-tax cost of debt is 10.9 percent, what is Jowers' cost of capital? The firm's tax rate is 34 percent. Jowers' cost of capital is %. (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts