Question: PLEASE SOLVE WITH CLEAR WRITING AND MAKE SURE THAT SOLUTION IS CORRECT. Q3) It is desired to construct an ammonia petrochemical plant with a capacity

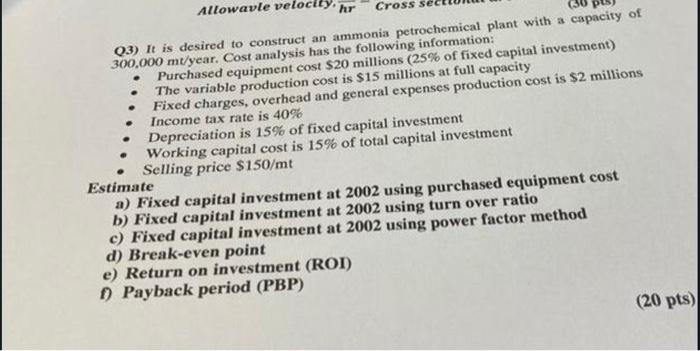

Q3) It is desired to construct an ammonia petrochemical plant with a capacity of 300,000mt/ year. Cost analysis has the following information: - Purchased equipment cost $20 millions ( 25% of fixed capital investment) - The variable production cost is $15 millions at full capacity - Income tax rate is 40% - Depreciation is 15% of fixed capital investment - Working capital cost is 15% of total capital investment - Selling price $150/mt a) Fixed capital investment at 2002 using purchased equipment cost Estimate b) Fixed capital investment at 2002 using turn over ratio d) Break-even point e) Return on investment (ROI) f) Payback period (PBP)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts