Question: please solve with explicit explanation You have the following information about the market. Average market capitalization of the companies of S&P 500 is USD 400mln,

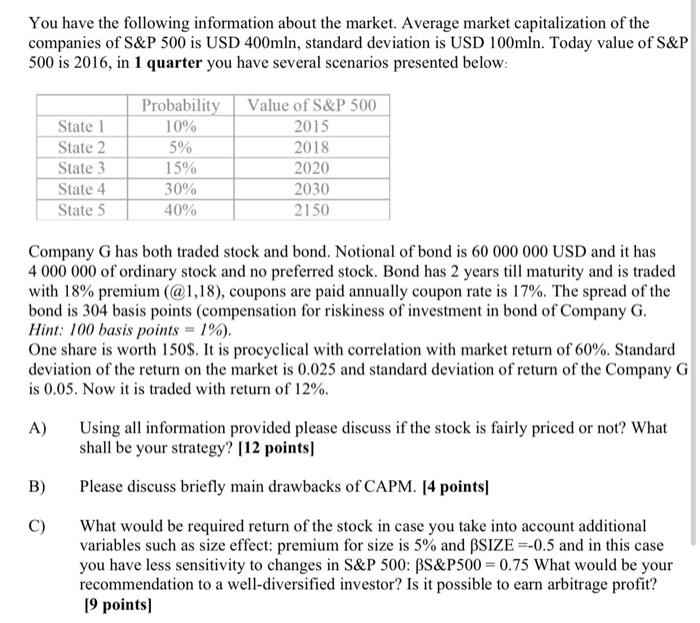

You have the following information about the market. Average market capitalization of the companies of S&P 500 is USD 400mln, standard deviation is USD 100mln. Today value of S&P 500 is 2016, in 1 quarter you have several scenarios presented below: Statel State 2 State 3 State 4 State 5 Probability 10% 5% 15% 30% 40% Value of S&P 500 2015 2018 2020 2030 2150 Company G has both traded stock and bond. Notional of bond is 60 000 000 USD and it has 4 000 000 of ordinary stock and no preferred stock. Bond has 2 years till maturity and is traded with 18% premium (@1,18), coupons are paid annually coupon rate is 17%. The spread of the bond is 304 basis points (compensation for riskiness of investment in bond of Company G. Hint: 100 basis points = 1%). One share is worth 150$. It is procyclical with correlation with market return of 60%. Standard deviation of the return on the market is 0.025 and standard deviation of return of the Company G is 0.05. Now it is traded with return of 12%. A) B) ) Using all information provided please discuss if the stock is fairly priced or not? What shall be your strategy? [12 points] Please discuss briefly main drawbacks of CAPM. [4 points) What would be required return of the stock in case you take into account additional variables such as size effect: premium for size is 5% and BSIZE =-0.5 and in this case you have less sensitivity to changes in S&P 500: BS&P500 = 0.75 What would be your recommendation to a well-diversified investor? Is it possible to earn arbitrage profit? [9 points) You have the following information about the market. Average market capitalization of the companies of S&P 500 is USD 400mln, standard deviation is USD 100mln. Today value of S&P 500 is 2016, in 1 quarter you have several scenarios presented below: Statel State 2 State 3 State 4 State 5 Probability 10% 5% 15% 30% 40% Value of S&P 500 2015 2018 2020 2030 2150 Company G has both traded stock and bond. Notional of bond is 60 000 000 USD and it has 4 000 000 of ordinary stock and no preferred stock. Bond has 2 years till maturity and is traded with 18% premium (@1,18), coupons are paid annually coupon rate is 17%. The spread of the bond is 304 basis points (compensation for riskiness of investment in bond of Company G. Hint: 100 basis points = 1%). One share is worth 150$. It is procyclical with correlation with market return of 60%. Standard deviation of the return on the market is 0.025 and standard deviation of return of the Company G is 0.05. Now it is traded with return of 12%. A) B) ) Using all information provided please discuss if the stock is fairly priced or not? What shall be your strategy? [12 points] Please discuss briefly main drawbacks of CAPM. [4 points) What would be required return of the stock in case you take into account additional variables such as size effect: premium for size is 5% and BSIZE =-0.5 and in this case you have less sensitivity to changes in S&P 500: BS&P500 = 0.75 What would be your recommendation to a well-diversified investor? Is it possible to earn arbitrage profit? [9 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts