Question: Please solve without excel. I will rate fast. Thanks :) 09.02-PR015 An investment of $800,000 is made in equipment that qualifies as 3-year equipment for

Please solve without excel. I will rate fast. Thanks :)

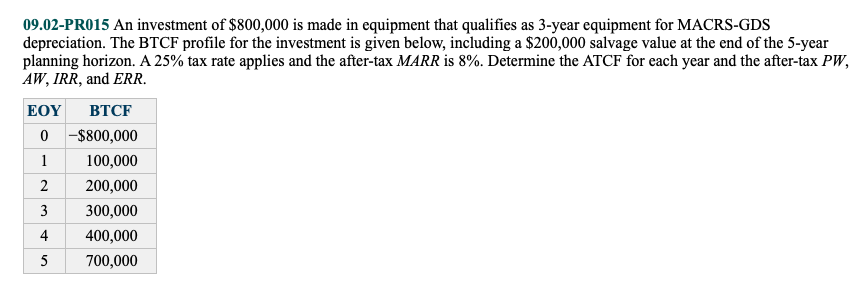

09.02-PR015 An investment of $800,000 is made in equipment that qualifies as 3-year equipment for MACRS-GDS depreciation. The BTCF profile for the investment is given below, including a $200,000 salvage value at the end of the 5-year planning horizon. A 25% tax rate applies and the after-tax MARR is 8%. Determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR EOY BTCF 0 $800,000 1 100,000 2 200,000 3 300,000 4 400,000 5 700,000 09.02-PR015 An investment of $800,000 is made in equipment that qualifies as 3-year equipment for MACRS-GDS depreciation. The BTCF profile for the investment is given below, including a $200,000 salvage value at the end of the 5-year planning horizon. A 25% tax rate applies and the after-tax MARR is 8%. Determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR EOY BTCF 0 $800,000 1 100,000 2 200,000 3 300,000 4 400,000 5 700,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts