Question: please solved this question Total Time:50 T-3 Management Accounting Q#01. (a) Explain difference between direct cost and direct costing (5) (b) Possible reasons for material

please solved this question

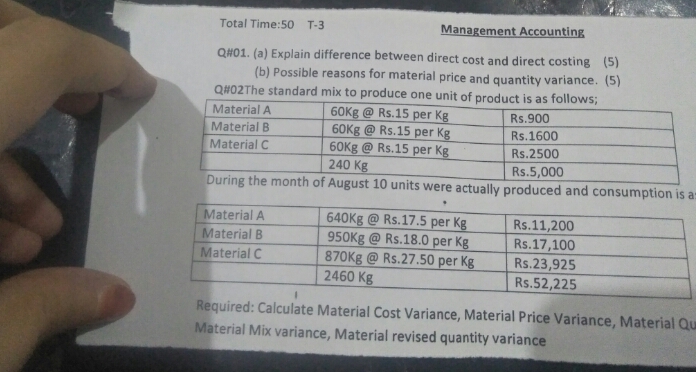

Total Time:50 T-3 Management Accounting Q#01. (a) Explain difference between direct cost and direct costing (5) (b) Possible reasons for material price and quantity variance. (5) Q#02The standard mix to produce one unit of product is as follows; Material A 60Kg @ Rs.15 per Kg Rs.900 Material B 60Kg @ Rs.15 per Kg Rs.1600 Material C 60Kg @ Rs.15 per Kg Rs.2500 240 Kg Rs.5,000 During the month of August 10 units were actually produced and consumption is a Material A 640Kg @ Rs.17.5 per Kg Rs.11,200 Material B 950Kg @ Rs.18.0 per Kg Rs.17,100 Material C 870Kg @ Rs.27.50 per Kg Rs.23,925 2460 Kg Rs.52,225 Required: Calculate Material Cost Variance, Material Price Variance, Material Qu Material Mix variance, Material revised quantity variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts