Question: Please somebody help me with this question 15. Scenario Analysis and Portfolio Risk. The common stock of Leaning Tower of Pita Inc., a restaurant chain,

Please somebody help me with this question

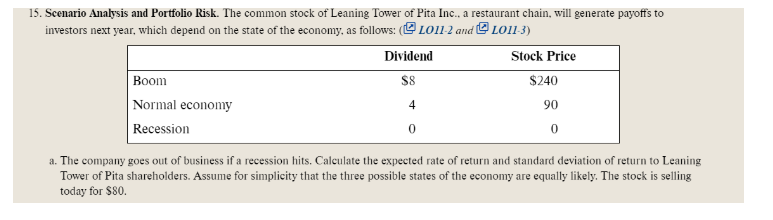

15. Scenario Analysis and Portfolio Risk. The common stock of Leaning Tower of Pita Inc., a restaurant chain, will generate payoffs to investors next year, which depend on the state of the economy, as follows: ( LO11-2 and 2011-3) Dividend Boom Stock Price $240 90 Normal economy Recession a. The company goes out of business if a recession hits. Calculate the expected rate of return and standard deviation of return to Leaning Tower of Pita shareholders. Assume for simplicity that the three possible states of the economy are equally likely. The stock is selling today for $80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts