Question: please someone help me Smith Industries has a proposed four-year project with $420,000 equipment cost that falls under the 5-year category using MACRS depreciation (there

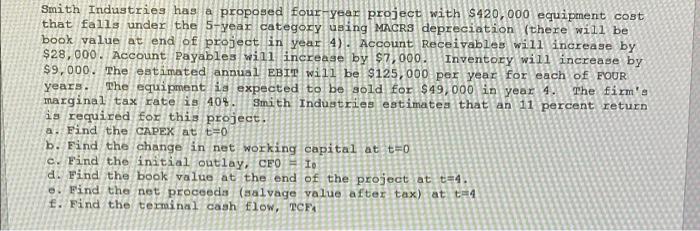

Smith Industries has a proposed four-year project with $420,000 equipment cost that falls under the 5-year category using MACRS depreciation (there will be book value at end of project in year 4). Account Receivables will increase by $28,000. Account Payables will increase by $7,000. Inventory will increase by $9,000. The estimated annual EBIT will be $125,000 per year for each of FOUR Years. The equipment is expected to be sold for $49,000 in year 4. The firm's marginal tax rate is 40% Smith Industries estimates that an 11 percent return is required for this project. a. Find the CAPEX at t=0 b. Find the change in net working capital at t=0 c. Pind the initial outlay, CFO IO d. Find the book value at the end of the project at t=4. e. Find the net proceeds (salvage value after tax) at ta4 f. Find the terminal cash flow, TCF4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts