Question: Please sovle and explain what formulas where used at each step! Thank you in advance! -E Stock Example You must estimate the intrinsic value of

Please sovle and explain what formulas where used at each step! Thank you in advance! -E

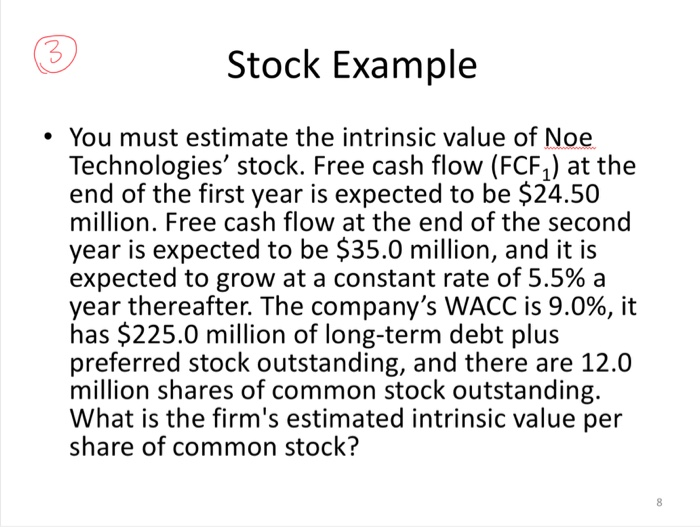

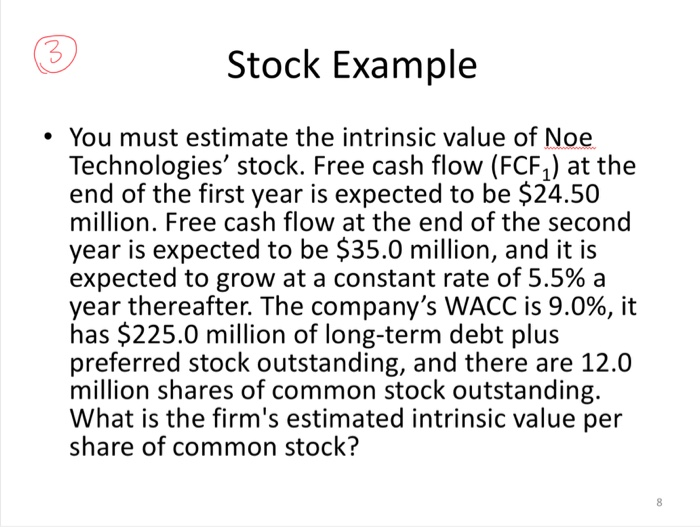

Stock Example You must estimate the intrinsic value of Noe Technologies' stock. Free cash flow (FCF1) at the end of the first year is expected to be $24.50 million. Free cash flow at the end of the second year is expected to be $35.0 million, and it is expected to grow at a constant rate of 5.5% a year thereafter. The company's WACC is 9.0%, it has $225.0 million of long-term debt plus preferred stock outstanding, and there are 12.0 million shares of common stock outstanding. What is the firm's estimated intrinsic value per share of common stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock